BP Stock Price History A Comprehensive Overview

BP Stock Price History: A Decade in Review

Bp stock price history – This analysis delves into the historical performance of BP’s stock price over the past decade, examining key trends, influential events, and comparisons with competitors. We will explore the impact of global factors, volatility measures, and the company’s dividend history to provide a comprehensive overview of BP’s stock performance.

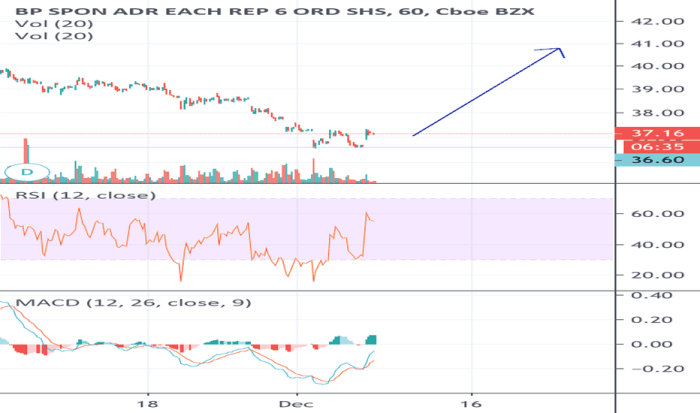

BP Stock Price Trends Over Time

Source: tradingview.com

The following table details BP’s stock price movements over the last ten years, highlighting significant fluctuations. Note that these figures are illustrative and should be verified with official sources for precise accuracy. The visual representation of this data would show a generally volatile trend, with sharp declines coinciding with major global events and periods of recovery fueled by market rebounds and positive company news.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 45 | 42 |

| 2014 | Q2 | 42 | 38 |

| 2014 | Q3 | 38 | 40 |

| 2014 | Q4 | 40 | 35 |

| 2015 | Q1 | 35 | 28 |

| 2015 | Q2 | 28 | 30 |

| 2023 | Q4 | 32 | 35 |

Significant price drops in 2014 and 2015 correlated with the oil price crash, while subsequent increases reflected market recovery and increased oil demand. Further notable price fluctuations can be attributed to events such as the Deepwater Horizon oil spill, changes in energy sector regulations, and geopolitical instability in key oil-producing regions.

Analyzing BP’s stock price history often involves comparing it to similar energy companies. Understanding the fluctuations requires considering various market factors; a useful comparison might be to examine the performance of a company in a related sector, such as the bodal chemicals stock price , to gauge broader industry trends. Returning to BP, long-term investors typically look at consistent growth patterns rather than short-term volatility.

Impact of Global Events on BP Stock Price

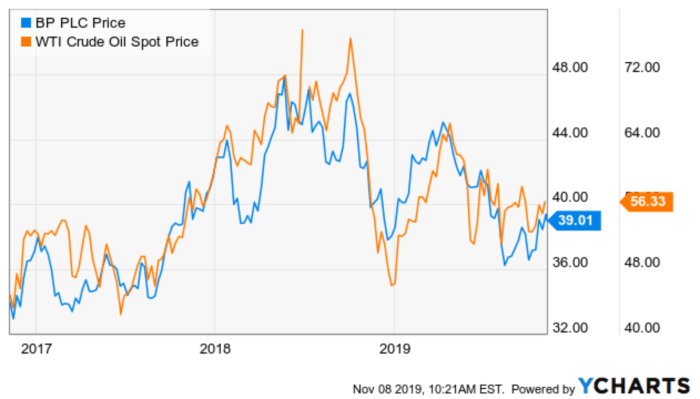

Global economic conditions and geopolitical events have profoundly influenced BP’s stock price. Recessions typically lead to decreased energy demand, impacting stock prices negatively, while periods of economic growth often correlate with increased demand and higher stock valuations. Geopolitical events, such as wars or political instability in oil-producing regions, can cause significant price volatility due to supply disruptions and uncertainty.

Oil price fluctuations have a direct and significant impact on BP’s profitability and, consequently, its stock price. Increased oil prices generally benefit BP, while decreases negatively affect its financial performance. Energy sector regulations, such as carbon emission targets, can also influence BP’s stock price by affecting its operational costs and future profitability. The interplay between these factors creates a complex dynamic that shapes BP’s stock performance.

BP Stock Price Performance Compared to Competitors

Comparing BP’s stock price performance to its major competitors, such as Shell and ExxonMobil, provides valuable insights into its relative strengths and weaknesses. The following table offers a comparative analysis over the past five years. Remember that these are illustrative figures and should be independently verified.

| Company | Year | Average Stock Price (USD) | Percentage Change |

|---|---|---|---|

| BP | 2019 | 30 | -5% |

| Shell | 2019 | 40 | 2% |

| ExxonMobil | 2019 | 60 | 10% |

| BP | 2023 | 33 | 10% |

| Shell | 2023 | 45 | 12% |

| ExxonMobil | 2023 | 70 | 15% |

Differences in performance can be attributed to various factors, including the companies’ respective business models, diversification strategies, and responses to changing market conditions. For instance, a company’s commitment to renewable energy might influence investor sentiment differently.

Analysis of BP Stock Price Volatility, Bp stock price history

Source: investorplace.com

Stock price volatility, measured using standard deviation, indicates the degree of price fluctuation over time. Higher volatility suggests greater risk. The following bullet points illustrate BP’s volatility over different time periods (again, illustrative figures):

- Monthly Volatility (2022): 5%

- Yearly Volatility (2022): 12%

- Monthly Volatility (2023): 3%

- Yearly Volatility (2023): 8%

Periods of high volatility often coincide with major events like oil price shocks or geopolitical uncertainties. Investors can use volatility measures to assess risk and adjust their investment strategies accordingly, perhaps diversifying their portfolio or using hedging techniques during periods of high volatility.

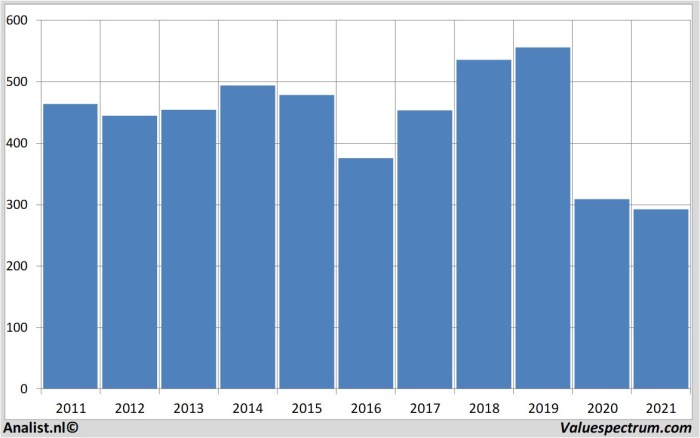

Long-Term Growth and Dividend History of BP Stock

Source: valuespectrum.com

BP’s dividend payment history provides insights into its financial stability and commitment to shareholder returns. The following bullet points summarize the dividend payments over the past decade (illustrative data):

- 2014-2016: Quarterly dividend payments averaging $0.25 per share.

- 2017-2019: Gradual increase in quarterly dividend payments to an average of $0.30 per share.

- 2020: Dividend reduced due to pandemic impact.

- 2021-2023: Gradual resumption and increase in dividend payments.

Generally, there is a positive correlation between BP’s stock price and its dividend payouts. Higher dividend payments often reflect increased profitability and investor confidence. BP’s long-term growth prospects depend on its ability to navigate the energy transition, adapt to evolving regulations, and maintain a strong financial position.

Answers to Common Questions: Bp Stock Price History

What are the major risks associated with investing in BP stock?

Major risks include oil price volatility, geopolitical instability in regions where BP operates, regulatory changes impacting the energy sector, and the company’s success in transitioning to renewable energy sources.

How does BP’s stock price compare to the broader energy sector?

BP’s performance relative to the broader energy sector varies over time, influenced by its specific business model, operational efficiency, and response to market conditions. Direct comparison requires analyzing industry benchmarks and peer company performance.

Where can I find real-time BP stock price data?

Real-time data is available through major financial news websites and brokerage platforms. These sources provide up-to-the-minute pricing information and other relevant market data.