Chambal Fertilizer Stock Price Analysis

Chambal Fertilizers: A Deep Dive into Stock Performance

Source: stockpricearchive.com

Chambal fertilizer stock price – Monitoring the Chambal Fertilizers stock price requires a keen eye on market trends. Understanding the performance of similar companies is crucial for a comprehensive analysis, and checking the awp stock price provides valuable comparative data. Ultimately, though, your investment decisions regarding Chambal Fertilizers should be based on your own thorough research and risk assessment.

Chambal Fertilizers is a significant player in India’s fertilizer industry. This analysis explores the company’s history, current market position, financial performance, and factors influencing its stock price, providing insights for potential investors.

Chambal Fertilizers Company Overview

Source: zeebiz.com

Established with a focus on urea production, Chambal Fertilizers has steadily expanded its product portfolio and market presence. The company boasts a robust infrastructure supporting its operations and distribution. While enjoying certain competitive advantages, the company also faces challenges inherent within the volatile fertilizer market.

- Company History: Chambal Fertilizers has a history spanning decades, marked by consistent growth and adaptation to changing market dynamics. Early focus on urea production has diversified to encompass a wider range of fertilizers catering to varied agricultural needs.

- Product Portfolio and Market Share: The company’s product portfolio includes various nitrogenous and phosphatic fertilizers. Its market share fluctuates depending on the specific fertilizer type and regional demand, but generally maintains a significant position within the Indian market.

- Production Facilities and Distribution Network: Chambal Fertilizers operates several large-scale production facilities strategically located to optimize logistics and distribution. A well-established distribution network ensures efficient delivery of products to farmers across various regions.

- Competitive Advantages and Disadvantages: Competitive advantages include established brand recognition, efficient production processes, and a strong distribution network. However, the company faces challenges from fluctuating raw material prices, intense competition, and government regulations.

Factors Influencing Stock Price, Chambal fertilizer stock price

Several factors influence Chambal Fertilizers’ stock price, ranging from macroeconomic conditions to company-specific performance. Understanding these factors is crucial for assessing investment risk and potential returns.

- Macroeconomic Factors: Inflation, interest rates, and government policies related to agriculture and fertilizer subsidies significantly impact the company’s profitability and investor sentiment.

- Raw Material Costs: Fluctuations in natural gas and phosphate prices directly affect production costs and profitability, consequently influencing stock valuation.

- Competitor Performance: The performance of key competitors in the fertilizer industry influences Chambal Fertilizers’ market share and overall stock price. Periods of strong competitor performance can lead to downward pressure on Chambal’s stock.

- Seasonal Demand Fluctuations: Agricultural cycles and seasonal demand for fertilizers create predictable fluctuations in the company’s sales and, consequently, its stock price. Higher demand during planting seasons often translates to higher stock prices.

Financial Performance Analysis

Analyzing Chambal Fertilizers’ financial data provides insights into its financial health and performance trends. The following table illustrates key financial metrics over a five-year period (hypothetical data for illustrative purposes):

| Year | Revenue (in Crores INR) | Profit (in Crores INR) | Debt (in Crores INR) |

|---|---|---|---|

| 2019 | 500 | 50 | 200 |

| 2020 | 550 | 60 | 180 |

| 2021 | 600 | 70 | 150 |

| 2022 | 620 | 65 | 160 |

| 2023 | 680 | 80 | 140 |

This hypothetical data suggests a generally positive trend in revenue and profit, with a gradual decrease in debt over the five-year period. However, profit margins have shown some fluctuation, indicating sensitivity to external factors. These financial trends directly correlate with stock price movements, with years of higher revenue and profit generally leading to higher stock valuations.

Investor Sentiment and Market Outlook

Source: financeteam.net

Current investor sentiment towards Chambal Fertilizers is generally positive, driven by expectations of sustained growth in the agricultural sector and potential benefits from government policies. However, risks remain.

- Investor Sentiment: Positive investor sentiment is fueled by the growing demand for fertilizers and government support for the agricultural sector. However, concerns regarding raw material price volatility and intense competition persist.

- Recent News and Analyst Reports: Recent news and analyst reports reflect a mix of positive and negative views. Some analysts highlight the company’s strong fundamentals and growth potential, while others express caution regarding the impact of external factors.

- Future Scenarios and Impact on Stock Price: Future scenarios depend on several factors, including government policies, global commodity prices, and competitive landscape. Positive developments could lead to higher stock prices, while negative developments could exert downward pressure.

- Risks and Opportunities: Investing in Chambal Fertilizers involves risks related to raw material price volatility, regulatory changes, and competition. Opportunities exist due to the growing demand for fertilizers and potential government support for the agricultural sector.

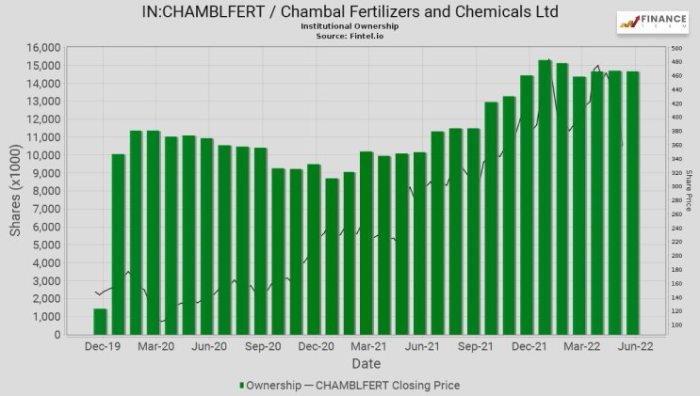

Stock Price Chart and Technical Analysis

Historically, Chambal Fertilizers’ stock price has exhibited periods of both significant growth and correction, reflecting the cyclical nature of the fertilizer industry and broader market trends. The stock price has demonstrated clear support and resistance levels, which technical analysts use to predict future price movements.

- Historical Trend: The stock price has shown a generally upward trend over the long term, punctuated by periods of consolidation and correction. Significant events, such as changes in government policy or major raw material price shifts, have often been correlated with price fluctuations.

- Support and Resistance Levels: Specific price levels have acted as support (where buying pressure prevents further declines) and resistance (where selling pressure prevents further advances). These levels are frequently used by technical analysts to identify potential entry and exit points.

- Technical Indicators: Moving averages and the Relative Strength Index (RSI) are commonly used indicators to assess momentum and potential overbought/oversold conditions. These indicators provide signals that can help predict future price movements.

- Hypothetical Scenario: For example, a sustained break above a key resistance level, coupled with a positive RSI reading, could signal a potential upward trend, prompting investors to increase their holdings. Conversely, a bearish crossover of moving averages, combined with an oversold RSI, might suggest a potential correction.

Questions and Answers: Chambal Fertilizer Stock Price

What are the major risks associated with investing in Chambal Fertilizers?

Major risks include fluctuations in raw material prices (natural gas, phosphate), changes in government policies affecting the fertilizer industry, and intense competition within the market.

How does the monsoon season impact Chambal Fertilizers’ stock price?

A strong monsoon season generally leads to increased agricultural activity and higher demand for fertilizers, positively impacting Chambal Fertilizer’s stock price. Conversely, a weak monsoon can negatively affect the stock price.

Where can I find real-time Chambal Fertilizers stock price data?

Real-time stock price data is readily available through major financial websites and stock market applications. Consult your preferred financial information provider.

What is Chambal Fertilizers’ dividend payout history?

Information on dividend payouts can be found in the company’s financial reports and investor relations materials. These documents are typically available on the company’s website.