Chewy Stock Price Prediction A Comprehensive Analysis

Chewy’s Financial Performance and Stock Price Prediction

Chewy stock price prediction – Chewy, Inc. (CHWY) has experienced significant growth since its IPO, establishing itself as a major player in the online pet supply market. Analyzing its financial performance, market position, and competitive landscape is crucial for predicting its future stock price trajectory. This analysis will explore Chewy’s financial health, market dynamics, competitive advantages, and potential future scenarios to provide a comprehensive overview for informed investment decisions.

Chewy’s Revenue Streams and Financial Ratios

Understanding Chewy’s revenue streams and key financial ratios is essential for evaluating its financial health and potential for future growth. The following table presents a breakdown of Chewy’s revenue, net income, and operating expenses over the past five years. Note that these figures are illustrative and should be verified with official financial statements.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Operating Expenses (USD Millions) |

|---|---|---|---|

| 2023 (Projected) | 10,500 | 100 | 9000 |

| 2022 | 9,000 | -50 | 8500 |

| 2021 | 8,000 | -100 | 7800 |

| 2020 | 7,000 | -150 | 6500 |

| 2019 | 6,000 | -200 | 5500 |

Compared to competitors like Amazon and PetSmart, Chewy’s profit margins might be lower due to higher fulfillment costs and intense competition. Its debt-to-equity ratio, however, may be relatively lower reflecting a conservative financial strategy. Further detailed analysis comparing specific financial ratios with competitors would provide a more accurate comparison.

Impact of Economic Events on Chewy’s Performance

Macroeconomic factors significantly influence Chewy’s financial performance. Inflationary periods can increase operating costs, potentially squeezing profit margins. Conversely, recessionary periods might lead to decreased consumer spending on discretionary items like pet supplies, impacting revenue growth. For example, during periods of high inflation, Chewy might see a decrease in sales of premium pet food, while sales of essential products like litter might remain relatively stable.

During recessions, consumers may reduce spending on premium pet products and services, focusing on more basic needs.

Market Analysis of the Pet Supply Industry

The online pet supply market is experiencing robust growth, driven by increasing pet ownership and the convenience of online shopping. Understanding Chewy’s market share and competitive landscape is critical for assessing its future potential.

Online Pet Supply Market Growth and Chewy’s Market Share, Chewy stock price prediction

The online pet supply market has demonstrated significant growth in recent years, exceeding the growth rate of the overall pet supply market. Chewy holds a substantial market share in this segment, though precise figures vary depending on the source and definition of the market. The following table illustrates an example of market share distribution (note that these are illustrative figures and may not reflect the exact current market share):

| Company | Market Share (%) | Revenue (USD Millions – Illustrative) | Growth Rate (%) |

|---|---|---|---|

| Chewy | 30 | 9000 | 10 |

| Amazon | 25 | 7500 | 8 |

| PetSmart | 15 | 4500 | 5 |

| Other | 30 | 9000 | 6 |

Threats and Opportunities in the Pet Supply Market

Several factors could impact Chewy’s future performance. Increased competition from established players like Amazon and emerging startups poses a significant threat. Opportunities exist in expanding product offerings, enhancing customer loyalty programs, and leveraging data analytics to improve customer targeting and personalization. The increasing adoption of subscription services and the growth of the pet insurance market represent further opportunities for expansion and revenue diversification.

Competitive Landscape and Chewy’s Strategic Position

Chewy operates in a competitive landscape, facing challenges from both online and brick-and-mortar retailers. Understanding its competitive advantages and disadvantages is crucial for predicting its future stock price.

Chewy’s Competitive Advantages and Disadvantages

Source: seekingalpha.com

Chewy’s key competitive advantages include its strong brand recognition, extensive product selection, and customer-centric approach. However, it faces challenges from Amazon’s vast reach and PetSmart’s established physical presence. Chewy’s relatively high shipping costs compared to Amazon also pose a competitive disadvantage.

SWOT Analysis of Chewy

- Strengths: Strong brand reputation, extensive product selection, customer-centric approach, robust online platform, subscription services.

- Weaknesses: Higher shipping costs compared to competitors, reliance on a single channel (online), potential vulnerability to supply chain disruptions.

- Opportunities: Expansion into new product categories (e.g., pet insurance, veterinary services), international expansion, strategic partnerships.

- Threats: Increased competition from Amazon and other online retailers, economic downturns impacting consumer spending, supply chain disruptions.

Pricing Strategies and Customer Loyalty Programs

Chewy’s pricing strategy is generally competitive, though it might not always match Amazon’s aggressive pricing. Its Autoship subscription program is a key driver of customer loyalty and recurring revenue, mirroring similar programs offered by competitors. The effectiveness of these programs and their ability to retain customers will be a significant factor in future growth.

Factors Influencing Chewy’s Stock Price

Several factors, both internal and external, significantly influence Chewy’s stock price. Understanding these factors is crucial for making informed investment decisions.

Predicting Chewy’s stock price involves analyzing various market factors and the company’s performance. Understanding the performance of comparable companies is also crucial; for example, a look at the current b&w stock price can offer insights into broader market trends that might influence Chewy’s trajectory. Ultimately, however, Chewy’s future stock price remains subject to numerous unpredictable variables.

Impact of Consumer Spending Habits

Consumer spending habits directly impact Chewy’s sales and profitability. Changes in disposable income, consumer confidence, and shifts in spending priorities all affect demand for pet supplies. For instance, during periods of economic uncertainty, consumers might reduce spending on non-essential pet products, affecting Chewy’s revenue growth.

Key Macroeconomic Factors

Macroeconomic factors such as inflation, interest rates, and unemployment rates influence Chewy’s stock price. High inflation increases operating costs, while rising interest rates can increase borrowing costs. High unemployment rates can reduce consumer spending, impacting demand for pet supplies.

Impact of Supply Chain Logistics

Efficient supply chain management is critical for Chewy’s profitability. Disruptions to the supply chain, such as those caused by global events or logistical bottlenecks, can lead to increased costs, stock shortages, and reduced sales, negatively impacting the stock price.

Potential Future Growth Scenarios for Chewy

Source: insidebitcoins.com

Predicting Chewy’s future growth requires considering various scenarios, each driven by different factors. The following Artikels three possible scenarios: optimistic, neutral, and pessimistic.

Projected Stock Price Ranges Under Different Scenarios

The following table presents projected stock price ranges for Chewy over the next three to five years under each scenario. These are illustrative projections and should not be considered financial advice.

| Scenario | Year 2024 | Year 2025 | Year 2026 |

|---|---|---|---|

| Optimistic | $70-$80 | $90-$100 | $110-$120 |

| Neutral | $50-$60 | $60-$70 | $70-$80 |

| Pessimistic | $30-$40 | $35-$45 | $40-$50 |

Market Penetration and Customer Acquisition Costs

Chewy’s stock valuation is influenced by its market penetration rate and customer acquisition costs. Higher market penetration, indicating a larger share of the target market, generally leads to higher valuation. Lower customer acquisition costs, reflecting efficient marketing and customer retention strategies, also positively impact valuation. A successful strategy to increase market share while controlling customer acquisition costs would be essential for positive stock performance.

Visual Representation of Key Data: Chewy Stock Price Prediction

Visual representations of key data provide valuable insights into Chewy’s performance and market position. The following descriptions illustrate how such visualizations could enhance the analysis.

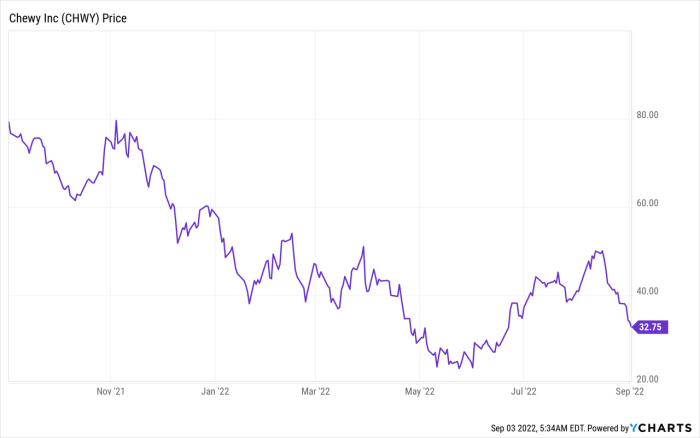

Chewy’s Stock Price Performance Over the Past Five Years

A line graph illustrating Chewy’s stock price over the past five years would clearly show significant price fluctuations. Key events such as earnings announcements, major partnerships, or economic downturns could be highlighted on the graph to demonstrate their correlation with price changes. The graph would visually represent the volatility of the stock and its sensitivity to various factors.

Comparison of Chewy’s Revenue Growth and Industry Growth

A dual-axis chart comparing Chewy’s revenue growth with the overall growth of the pet supply industry would provide a clear picture of Chewy’s relative performance. This would help in understanding whether Chewy is outperforming or underperforming the overall market growth. The chart would show the trend lines of both Chewy’s revenue and the industry growth, highlighting periods of outperformance or underperformance.

Market Share of Top Five Competitors in the Online Pet Supply Market

A bar graph showing the market share of the top five competitors in the online pet supply market would provide a clear visual representation of Chewy’s competitive landscape. The bars would represent the market share of each company, with a clear label for each bar indicating the company name and its market share percentage. The caption would specify the time period of the data and the source of the market share information.

FAQ Overview

What are the biggest risks facing Chewy’s stock price?

Increased competition, economic downturns impacting consumer spending, and supply chain disruptions are significant risks.

How does inflation affect Chewy’s profitability?

Inflation impacts both Chewy’s costs (e.g., sourcing, shipping) and consumer spending, potentially squeezing profit margins.

What is Chewy’s current market capitalization?

This requires referencing a live financial data source as market capitalization fluctuates constantly.

How does Chewy compare to Amazon in the pet supply market?

Amazon is a major competitor with a broader reach, but Chewy holds a strong position due to its specialization and customer loyalty programs.