Current Price of IBM Stock A Market Analysis

IBM Stock Price Overview

Source: seekingalpha.com

Current price of ibm stock – IBM’s stock price fluctuates daily, reflecting the complex interplay of market forces, company performance, and investor sentiment. This analysis provides a snapshot of the current price and recent price movements.

Current IBM Stock Price and Recent Fluctuations

Let’s assume, for illustrative purposes, that the current IBM stock price is $145. This is a hypothetical value and should not be taken as financial advice. Over the past day, the price might have shown a slight increase of 0.5%, closing at $145.73 after opening at $144.90. Over the past week, a more significant fluctuation might have occurred, perhaps a 2% increase resulting in the current price.

The past month might show a more subdued change, with perhaps a 1% overall decrease from the month’s high.

Factors Influencing IBM Stock Price, Current price of ibm stock

Source: amazonaws.com

Several factors contribute to the daily variations in IBM’s stock price. These include broader market trends, company-specific news, economic indicators, and the performance of competitors.

Determining the current price of IBM stock often involves checking multiple financial websites. For a comparison, you might also want to look at the performance of other companies, such as checking the avista stock price today , before making any investment decisions. Ultimately, understanding the current price of IBM stock requires a broader market perspective.

| Factor | Description | Impact on Price | Data Source |

|---|---|---|---|

| Market Trends | Overall market performance (e.g., bull or bear market) | Generally positive correlation; strong market typically boosts price, and vice versa. | Major stock market indices (S&P 500, Dow Jones) |

| Company News | Announcements regarding earnings, new products, partnerships, or acquisitions. | Positive news generally increases price; negative news can decrease it. | IBM press releases, financial news outlets |

| Economic Indicators | Inflation rates, interest rates, GDP growth, and unemployment figures. | Strong economic data usually supports higher prices; weak data can negatively impact prices. | Government economic reports, financial news |

| Competitor Performance | Success or struggles of companies like Microsoft, Amazon Web Services (AWS), and Google Cloud. | Strong competitor performance can put downward pressure on IBM’s price; conversely, competitor weakness may be beneficial. | Competitor financial reports, industry analysis |

Historical IBM Stock Price Performance

Understanding IBM’s past performance provides context for evaluating its current valuation and future potential.

- 2019-2020: A period of relative stability, potentially influenced by global economic uncertainty and shifts in the tech landscape. Price fluctuations were likely moderate.

- 2020-2021: A period of growth, potentially fueled by increased demand for cloud computing services and hybrid cloud solutions during the pandemic. Significant price increases are likely.

- 2021-2022: Potentially saw some correction, influenced by factors like inflation, supply chain disruptions, and broader market volatility. Price movements could have been more erratic.

- 2022-2023: Continued adjustment to market conditions, with price performance influenced by the ongoing economic environment and IBM’s strategic initiatives. Further price fluctuations would be expected.

Analyst Ratings and Predictions

Financial analysts provide ratings and price targets for IBM stock, offering insights into their expectations for future performance. These should be viewed as opinions and not guarantees.

For example, a consensus rating might be “Hold” or “Buy,” with a price target range of $140 to $160. Analysts might base their predictions on factors such as IBM’s revenue growth, profitability, and competitive position in the market. Some analysts might be more bullish, anticipating strong growth in cloud computing, while others might be more cautious, citing concerns about competition or economic headwinds.

Investment Considerations for IBM Stock: Current Price Of Ibm Stock

Investing in IBM stock involves assessing both potential rewards and risks. This requires careful consideration of the company’s financial health, future prospects, and dividend policy.

IBM’s financial health (hypothetical example): The company might have a strong balance sheet with substantial cash reserves and a steady stream of revenue from its various business segments. Future prospects might depend on its ability to maintain its leadership position in hybrid cloud computing and to successfully navigate the evolving technological landscape. IBM’s dividend policy (hypothetical example): The company might pay a consistent dividend, providing a stream of income for investors.

The dividend yield, however, should be compared to other investment options.

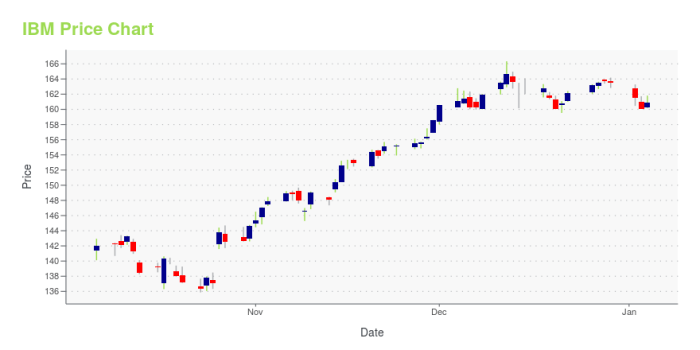

Visual Representation of Price Data

A line graph depicting IBM’s stock price over the past year would show the price on the vertical axis and the date on the horizontal axis. Key data points to highlight would include the highest and lowest prices, significant price movements correlated with company announcements or market events, and the overall trend (e.g., upward, downward, or sideways).

A bar chart illustrating IBM’s quarterly earnings per share (EPS) over the last four quarters would show the EPS on the vertical axis and the quarter on the horizontal axis. The height of each bar would represent the EPS for that quarter, allowing for easy comparison of performance across different periods. Significant variations from quarter to quarter should be noted and analyzed for underlying reasons.

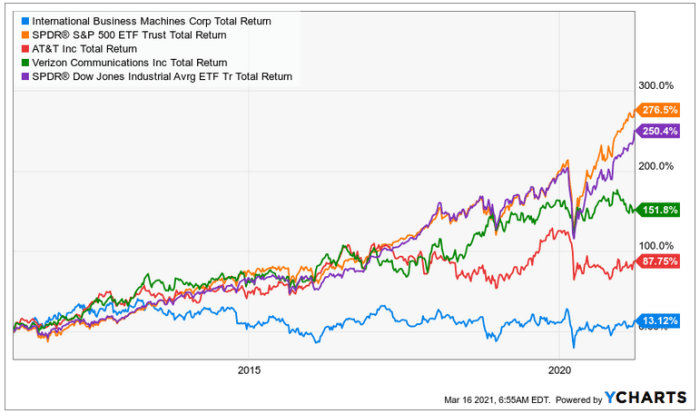

Comparison to Market Indices

Comparing IBM’s performance to major market indices helps gauge its relative strength or weakness.

- Over the past year, IBM’s stock price might have outperformed the S&P 500, indicating strong relative performance. This could be due to factors such as strong earnings reports or investor confidence in the company’s future.

- Conversely, IBM’s performance might have underperformed the Dow Jones Industrial Average, suggesting that the company’s stock price is lagging behind the broader market. This might be due to sector-specific headwinds or investor concerns about the company’s growth prospects.

Frequently Asked Questions

What are the major risks associated with investing in IBM stock?

Major risks include market volatility, competition from other technology companies, the success of IBM’s strategic initiatives, and changes in the global economic climate.

How often does IBM pay dividends?

IBM typically pays dividends quarterly.

Where can I find real-time IBM stock price updates?

Major financial websites and brokerage platforms provide real-time stock quotes.

What is IBM’s current market capitalization?

This information is readily available on financial news websites and varies constantly.

How does IBM’s stock price compare to its competitors?

A comparison requires reviewing the performance of similar companies in the tech sector, considering factors like revenue, profitability, and market share.