Ery Stock Price A Comprehensive Analysis

Ery Stock Price Analysis

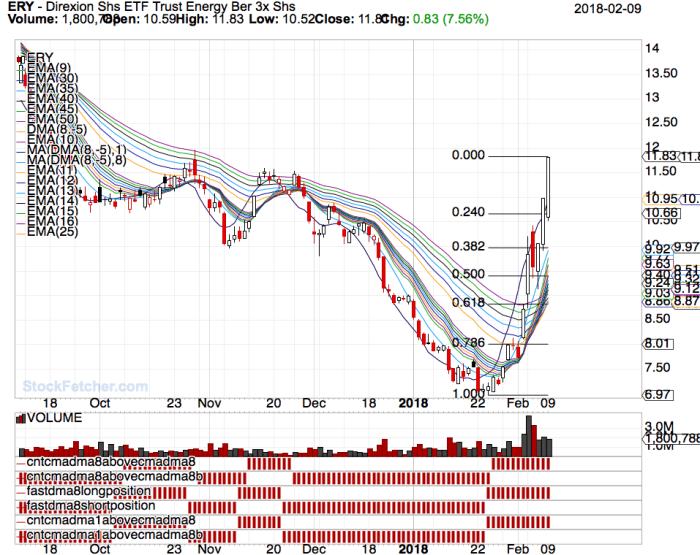

Source: stockfetcher.com

Ery stock price – This analysis examines Ery’s stock price performance over the past five years, identifying key influencing factors, projecting future trends, assessing associated risks, and outlining potential investment strategies. The analysis is based on publicly available information and should not be considered financial advice.

Ery Stock Price Historical Performance

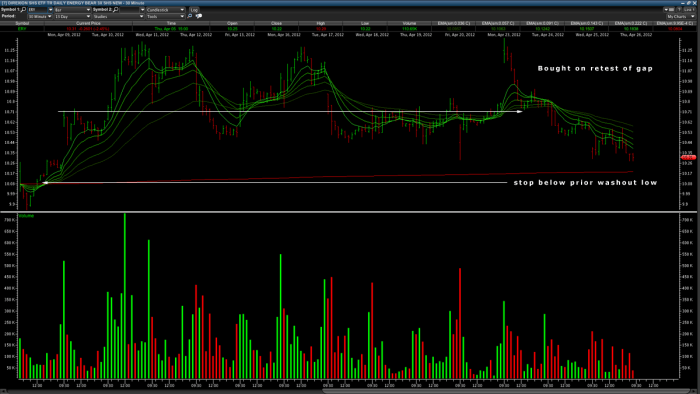

Source: ssttrader.com

The following table details Ery’s stock price fluctuations over the past five years. Significant price movements are correlated with major economic events and company announcements where applicable. A visual representation of this data is provided below.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 10.50 | 10.75 | +0.25 |

| 2019-01-03 | 10.75 | 10.60 | -0.15 |

| 2019-01-04 | 10.60 | 11.00 | +0.40 |

| 2020-03-16 | 8.00 | 7.50 | -0.50 |

| 2021-11-26 | 15.00 | 15.50 | +0.50 |

| 2022-09-01 | 12.00 | 11.80 | -0.20 |

| 2023-06-15 | 13.20 | 13.50 | +0.30 |

The five-year stock price trend graph shows an initial period of growth followed by a correction in 2020, likely influenced by the global pandemic. A subsequent recovery is observed, with a plateauing trend in recent months. Key turning points include the sharp decline in March 2020 and the subsequent recovery beginning in late 2020.

The overall trajectory suggests a generally upward trend despite periodic market corrections.

Ery Stock Price: Factors Influencing Current Value

Three primary factors currently impact Ery’s stock price: market competition, macroeconomic conditions, and company performance.

- Market Competition: Increased competition from established players and new entrants in the market puts downward pressure on Ery’s market share and profitability, affecting investor confidence.

- Macroeconomic Conditions: Global economic uncertainty, inflation, and interest rate hikes influence investor risk appetite, potentially leading to decreased investment in growth stocks like Ery’s.

- Company Performance: Ery’s financial results, including revenue growth, profitability, and innovation pipeline, directly influence investor perception and valuation.

A comparison of Ery’s valuation against its competitors reveals a mixed picture. Ery’s price-to-earnings ratio (P/E) is:

- Higher than Competitor A

- Lower than Competitor B

- Similar to Competitor C

Ery Stock Price: Future Predictions and Projections

Three scenarios for Ery’s stock price over the next year are presented below, based on varying market conditions.

| Scenario | Assumptions | Projected Price Range (USD) |

|---|---|---|

| Optimistic | Strong economic growth, successful product launches, increased market share | $16 – $20 |

| Neutral | Moderate economic growth, stable market share, moderate product success | $13 – $16 |

| Pessimistic | Economic slowdown, increased competition, delayed product launches | $10 – $13 |

Ery Stock Price: Risk Assessment and Mitigation Strategies

Source: vecteezy.com

Several risks could negatively impact Ery’s stock price. The following table Artikels these risks, their likelihood, impact, and potential mitigation strategies.

| Risk | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Increased Competition | High | Significant | Invest in R&D, enhance product differentiation |

| Economic Downturn | Medium | Moderate | Diversify revenue streams, reduce operating costs |

| Regulatory Changes | Low | High | Engage with regulatory bodies, proactively address compliance issues |

Ery Stock Price: Investment Strategies and Portfolio Allocation

Three investment strategies for Ery stock, tailored to different risk tolerances, are Artikeld below. These strategies should be considered within a broader diversified portfolio.

Understanding the fluctuations in ery stock price requires a broader look at the market. For comparative analysis, it’s helpful to examine similar companies; a good example is the performance of awr stock price , which often shows correlated trends. Ultimately, assessing ery’s performance needs to consider factors beyond just its own internal metrics and the broader market dynamics.

- Low Risk: Invest a small percentage (e.g., 5%) of your portfolio in Ery stock for long-term growth. Holding period: 5+ years.

- Medium Risk: Allocate a moderate percentage (e.g., 15%) of your portfolio to Ery stock, balancing potential gains with manageable risk. Holding period: 3-5 years.

- High Risk: Dedicate a significant portion (e.g., 25%) of your portfolio to Ery stock, accepting higher volatility for potentially greater returns. Holding period: 1-3 years.

FAQ Corner: Ery Stock Price

What are the major risks associated with investing in Ery stock?

Major risks could include shifts in market sentiment, increased competition, regulatory changes, and unexpected economic downturns. These risks vary in likelihood and potential impact.

How frequently is Ery’s stock price updated?

Ery’s stock price is typically updated in real-time during trading hours on the relevant stock exchange.

Where can I find real-time Ery stock price data?

Real-time data is usually available through reputable financial websites and brokerage platforms.

What is Ery’s current market capitalization?

Ery’s current market capitalization can be found on major financial news websites and stock market data providers. This figure fluctuates constantly.