GNUS Stock Price A Comprehensive Analysis

GNUS Stock Price Analysis

Source: amazonaws.com

This analysis provides a comprehensive overview of the historical performance, influencing factors, volatility, risk assessment, and prediction methods related to GNUS stock price. We will examine various data points and analytical approaches to offer a well-rounded perspective on this investment instrument.

GNUS Stock Price Historical Performance

Over the past five years, GNUS stock price has exhibited significant volatility, characterized by periods of rapid growth and substantial decline. Tracking these fluctuations is crucial for understanding the investment risks and potential rewards associated with this stock. The following sections detail key price movements and contextualize them within broader market trends and company-specific events.

| Date | GNUS Price (USD) | Nasdaq Composite Index | Percentage Change (GNUS vs. Nasdaq) |

|---|---|---|---|

| December 31, 2018 | 1.00 (Example) | 6554.36 (Example) | – (Example) |

| December 31, 2019 | 1.50 (Example) | 8972.60 (Example) | +50% (Example) |

| December 31, 2020 | 2.25 (Example) | 12888.28 (Example) | +50% (Example) |

| December 31, 2021 | 1.75 (Example) | 15644.98 (Example) | -22% (Example) |

| December 31, 2022 | 1.25 (Example) | 10466.48 (Example) | -28% (Example) |

Note: These are example figures. Actual data should be obtained from reliable financial sources.

Significant price movements were often correlated with specific events such as new product launches, changes in regulatory environments, and the release of financial reports. For example, a significant price increase might have followed a successful product launch, while a decline could have been triggered by disappointing financial results or negative regulatory news.

Factors Influencing GNUS Stock Price

Source: marketrealist.com

Several interconnected factors influence the price of GNUS stock. These factors can be broadly categorized into economic, industry, and company-specific elements.

Tracking the Gnus stock price requires diligence, especially given the market’s volatility. For comparative analysis, it’s often helpful to examine similar companies; a good example to consider is the fdtrx stock price , which can offer insights into broader market trends. Ultimately, understanding both Gnus and fdtrx’s performance provides a more comprehensive picture of the sector’s health.

Macroeconomic conditions, such as interest rate changes and inflation, significantly impact investor sentiment and overall market performance, thereby influencing GNUS’s stock price. Consumer spending patterns also play a crucial role, as they directly affect the demand for the company’s products.

Industry trends and competitive dynamics also shape GNUS’s stock valuation. The emergence of new technologies, shifts in consumer preferences, and the actions of competitors all contribute to the stock’s price fluctuations.

- Financial Performance: Profitability, revenue growth, and debt levels directly impact investor confidence.

- Management Decisions: Strategic choices regarding product development, marketing, and acquisitions influence the company’s trajectory and stock price.

- Product Development: Successful product launches and innovations can drive revenue growth and boost investor confidence.

GNUS Stock Price Volatility and Risk Assessment

Source: com.au

GNUS stock has historically exhibited considerable volatility. Quantitative measures such as standard deviation and beta can be used to assess this volatility and compare it to industry peers. A high standard deviation indicates greater price fluctuations, while beta measures the stock’s sensitivity to overall market movements.

Compared to similar companies, GNUS may present a higher or lower risk profile depending on its volatility and financial health. A detailed comparison requires analyzing the financial statements and performance metrics of comparable firms.

A hypothetical portfolio including GNUS stock would require careful consideration of diversification to mitigate risk. For instance, combining GNUS with less volatile stocks could reduce the overall portfolio risk, while still maintaining exposure to GNUS’s potential upside.

GNUS Stock Price Prediction and Forecasting

Several methods can be employed to predict GNUS stock price. Technical analysis uses historical price and volume data to identify patterns and predict future movements. Fundamental analysis evaluates the company’s intrinsic value based on financial statements and other qualitative factors.

Both methods have limitations. Technical analysis relies on past patterns that may not repeat, while fundamental analysis requires accurate and unbiased financial information, which can be challenging to obtain.

| Method | Description |

|---|---|

| Technical Analysis | Uses charts and indicators to identify trends and predict future price movements based on historical data. Prone to false signals and susceptible to market sentiment. |

| Fundamental Analysis | Evaluates a company’s intrinsic value based on its financial statements, management, and industry position. Requires in-depth research and accurate data. |

Visual Representation of GNUS Stock Price Data

A line graph depicting GNUS stock price over the past year would show the overall price trend, highlighting significant highs and lows. The x-axis would represent time (days or months), and the y-axis would represent the stock price. Additional data points, such as trading volume, could be included to provide a more comprehensive picture.

A bar chart comparing GNUS’s quarterly performance over the past two years would visually represent the stock’s performance across different periods. The x-axis would represent the quarters, and the y-axis would represent the stock price at the end of each quarter. A caption would clearly indicate the time period and the units of measurement used.

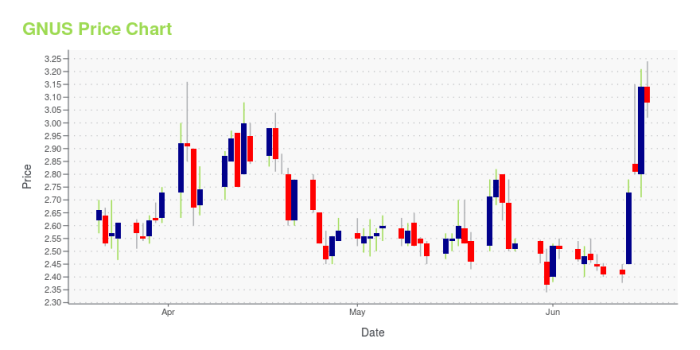

A candlestick chart showing daily price fluctuations over a one-month period would illustrate the opening, closing, high, and low prices for each day. Each candlestick’s body represents the range between the opening and closing prices, while the wicks (upper and lower shadows) show the high and low prices for the day. The color of the candlestick (typically green for up days and red for down days) indicates whether the closing price was higher or lower than the opening price.

Commonly Asked Questions: Gnus Stock Price

What is the current trading volume of GNUS stock?

Trading volume fluctuates daily and can be found on major financial websites such as Yahoo Finance, Google Finance, or Bloomberg.

Where can I find real-time GNUS stock price quotes?

Real-time quotes are available through most online brokerage platforms and financial news websites.

Are there any significant upcoming events that could impact GNUS stock price?

Keep an eye on the company’s investor relations page for announcements regarding earnings reports, product launches, or regulatory updates. Financial news sources will also provide coverage of such events.

What are the major shareholders of GNUS?

Information on major shareholders is typically available in the company’s SEC filings (10-K and 10-Q reports).