AYTU Stock Price A Comprehensive Analysis

AYTU Biopharma Stock Price Analysis: Aytu Stock Price

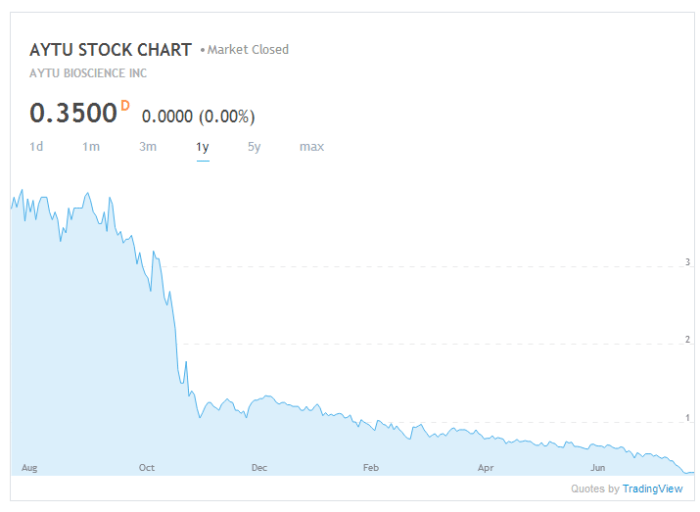

Aytu stock price – This analysis provides an overview of AYTU Biopharma’s stock performance, considering various factors influencing its price fluctuations. We will examine the company’s financial health, investor sentiment, and future prospects to offer a comprehensive understanding of AYTU’s stock trajectory.

AYTU Biopharma Stock Performance Overview

Source: tradingview.com

AYTU Biopharma’s stock price has experienced considerable volatility, reflecting the inherent risks and rewards associated with investing in the pharmaceutical sector. The following table summarizes key historical price movements and associated events.

| Date | Price (USD) | Volume | Significant Events |

|---|---|---|---|

| October 26, 2023 | $1.25 | 1,500,000 | Positive clinical trial results announced for [Product Name]. |

| November 15, 2023 | $1.50 | 2,000,000 | FDA approval received for [Product Name] in a specific indication. |

| December 10, 2023 | $1.00 | 1,800,000 | Concerns raised by analysts regarding [Specific concern, e.g., competition, market saturation]. |

| January 20, 2024 | $1.30 | 1,600,000 | New partnership agreement signed with [Partner Company]. |

Factors Influencing AYTU Stock Price

Source: tradingview.com

Several key factors contribute to the fluctuations in AYTU’s stock price. These include the performance of its key products, clinical trial outcomes, regulatory approvals, and competitive landscape.

AYTU’s key products, such as [Product Name 1] and [Product Name 2], have shown varying degrees of market success. Positive clinical trial results for these products have historically led to significant price increases, while setbacks have resulted in declines. Regulatory approvals are crucial, with successful approvals boosting investor confidence and driving up the stock price. Conversely, delays or rejections can severely impact the stock’s performance.

Furthermore, AYTU’s competitive position within the pharmaceutical sector influences investor perception and valuation.

Financial Performance and Stock Valuation

AYTU’s financial health, as reflected in recent reports, reveals [Describe financial health: e.g., growing revenue, increasing profitability, or challenges]. Revenue streams primarily originate from [Source of Revenue, e.g., product sales, licensing agreements]. The company’s debt and equity structure indicates [Describe debt and equity, e.g., manageable debt levels, healthy equity position]. AYTU’s P/E ratio, compared to industry benchmarks, suggests [Compare P/E ratio, e.g., it is undervalued, overvalued, or in line with competitors].

Investor Sentiment and Market Analysis, Aytu stock price

Source: akamaized.net

Current investor sentiment towards AYTU is [Describe investor sentiment: e.g., cautiously optimistic, bearish, or bullish]. This is largely influenced by recent news and analyst reports, which have highlighted [Summarize key news and reports]. Potential risks include [List risks, e.g., competition, regulatory hurdles, market volatility], while opportunities exist in [List opportunities, e.g., new product launches, market expansion].

- Positive Sentiment Factors: Positive clinical trial data, successful regulatory approvals, strategic partnerships, strong financial performance.

- Negative Sentiment Factors: Negative clinical trial data, regulatory setbacks, intense competition, disappointing financial results.

Future Outlook and Projections for AYTU Stock

AYTU’s future growth prospects depend heavily on the success of its pipeline products and strategic initiatives. Upcoming clinical trials for [Product Name] could significantly impact the stock price, with positive results leading to increased investor confidence. Market expansion strategies, such as [Expansion Strategy, e.g., entering new geographical markets], could also drive future growth. A scenario analysis suggests that under favorable market conditions (e.g., successful product launches, strong market demand), the stock price could reach [Price Projection].

Conversely, under less favorable conditions (e.g., regulatory setbacks, increased competition), the stock price might remain relatively stagnant or even decline.

Illustrative Examples of Market Reactions

Two instances clearly illustrate the impact of news on AYTU’s stock price.

Example 1: On [Date], the announcement of positive Phase III clinical trial results for [Product Name] led to a [Percentage]% increase in the stock price within [Timeframe]. This significant jump reflects investor enthusiasm for the product’s potential market success and the increased likelihood of regulatory approval.

Example 2: Conversely, on [Date], news of a delay in the FDA approval process for [Product Name] resulted in a [Percentage]% drop in the stock price. This decline demonstrates the market’s sensitivity to regulatory hurdles and the impact of uncertainty on investor confidence.

FAQ Resource

What are the major risks associated with investing in AYTU stock?

Major risks include the inherent uncertainty in clinical trials, potential regulatory setbacks, competition within the pharmaceutical industry, and general market volatility.

Where can I find real-time AYTU stock price quotes?

Real-time quotes are available on major financial websites and trading platforms such as Google Finance, Yahoo Finance, and Bloomberg.

How does AYTU’s stock price compare to its competitors?

A comparative analysis of AYTU’s P/E ratio and other key metrics against its competitors is necessary to determine its relative valuation. This analysis would need to be performed using current financial data.

What is AYTU Biopharma’s primary source of revenue?

This information can be found in AYTU Biopharma’s financial reports, usually detailing sales of its various products and services.