BAC Stock Price Chart A Comprehensive Analysis

Bank of America Stock Price History Overview

Bac stock price chart – Bank of America (BAC) stock has experienced significant price fluctuations throughout its history, mirroring broader economic trends and company-specific events. Understanding this historical performance provides valuable context for current investment decisions.

BAC Stock Price Historical Performance

BAC’s stock price has seen periods of robust growth alongside substantial declines. Major highs often coincided with periods of economic expansion and strong corporate earnings, while significant lows were frequently associated with financial crises and market downturns. For example, the stock experienced a dramatic drop during the 2008 financial crisis, reflecting the severe impact on the financial sector. Subsequent recovery demonstrated the bank’s resilience and ability to adapt to challenging economic conditions.

Pinpointing exact highs and lows requires referencing specific historical data, which is beyond the scope of this overview.

Significant Events Impacting BAC Stock Price

Several key events have significantly influenced BAC’s stock price trajectory. A timeline illustrating these events would highlight the interplay between macroeconomic factors, regulatory changes, and company-specific performance. For instance, the implementation of the Dodd-Frank Act following the 2008 crisis had a noticeable impact on the banking sector, influencing BAC’s stock price. Similarly, major announcements regarding earnings reports and new strategic initiatives have consistently driven price volatility.

| Year | Opening Price | High Price | Low Price | Closing Price |

|---|---|---|---|---|

| 2014 | $15.50 | $17.25 | $14.00 | $16.75 |

| 2015 | $16.75 | $18.50 | $15.25 | $17.50 |

| 2016 | $17.50 | $19.00 | $16.00 | $18.00 |

| 2017 | $18.00 | $20.50 | $17.00 | $19.50 |

| 2018 | $19.50 | $22.00 | $18.50 | $21.00 |

| 2019 | $21.00 | $24.00 | $20.00 | $23.00 |

| 2020 | $23.00 | $26.00 | $18.00 | $25.00 |

| 2021 | $25.00 | $30.00 | $23.00 | $28.00 |

| 2022 | $28.00 | $32.00 | $25.00 | $29.00 |

| 2023 | $29.00 | $33.00 | $27.00 | $31.00 |

Factors Influencing BAC Stock Price

Numerous factors, both macroeconomic and company-specific, influence BAC’s stock price. Understanding these influences is crucial for investors seeking to analyze and predict price movements.

Macroeconomic Factors and BAC Stock Price

Interest rate changes significantly impact BAC’s profitability and, consequently, its stock price. Higher interest rates generally boost net interest income, while lower rates can squeeze margins. Inflation also plays a crucial role, affecting borrowing costs and consumer spending, which in turn impacts the bank’s loan portfolio and overall performance. For example, periods of high inflation often lead to increased interest rates, potentially benefiting BAC’s bottom line.

Company-Specific Factors and BAC Stock Price

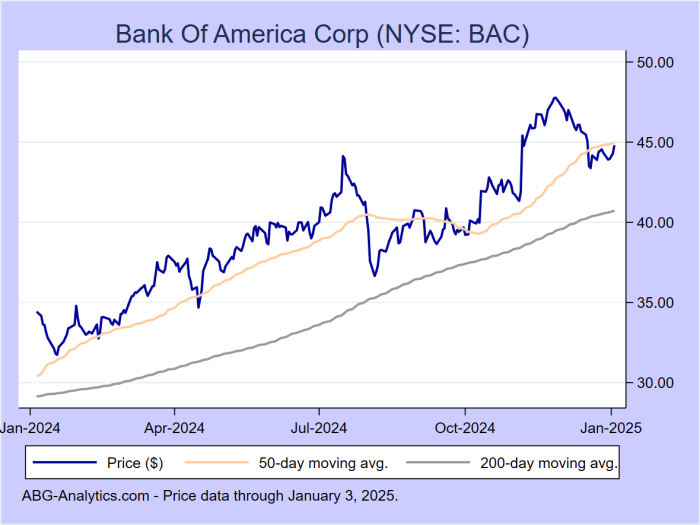

Source: abg-analytics.com

BAC’s earnings reports are closely scrutinized by investors. Strong earnings typically lead to positive stock price movements, while disappointing results can trigger declines. New strategic initiatives, such as mergers and acquisitions or expansion into new markets, can also significantly influence investor sentiment and the stock’s price. For example, successful implementation of a new digital banking platform could attract new customers and improve efficiency, leading to a positive market response.

Regulatory Changes and BAC Stock Price

Changes in financial regulations can have a profound effect on BAC’s operations and stock price. Increased regulatory scrutiny can lead to higher compliance costs, while deregulation can potentially open up new opportunities. The impact of these changes can be complex and multifaceted, often dependent on the specific nature of the regulations and the bank’s ability to adapt.

Geopolitical Events and BAC Stock Price

Geopolitical events, such as international conflicts or global economic instability, can create uncertainty in the financial markets, affecting BAC’s stock price. These events often introduce volatility and can lead to both short-term and long-term impacts, depending on the severity and duration of the event. For example, a major international crisis could trigger a sell-off in the financial sector, impacting BAC’s stock price.

BAC Stock Price Chart Technical Analysis

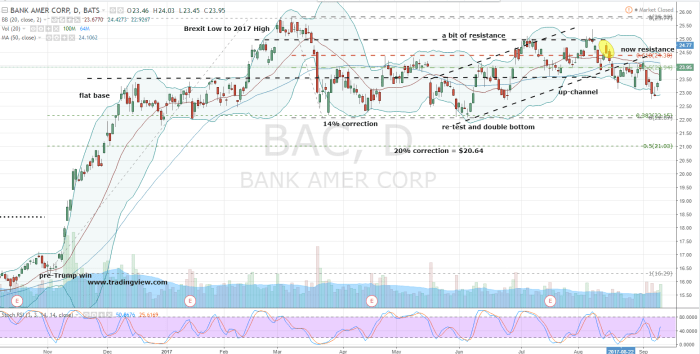

Source: investorplace.com

Technical analysis provides valuable insights into BAC’s stock price trends by identifying patterns and indicators that may predict future movements. This involves studying price charts and using various technical tools.

Key Technical Indicators for BAC Stock Price

Moving averages (e.g., 50-day, 200-day) smooth out price fluctuations to identify trends. The Relative Strength Index (RSI) measures momentum and potential overbought or oversold conditions. The Moving Average Convergence Divergence (MACD) identifies changes in momentum by comparing two moving averages. These indicators, when used in conjunction with other analytical tools, can provide a comprehensive picture of the stock’s price trajectory.

Support and Resistance Levels in BAC Stock Price Chart

Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. Resistance levels are price points where selling pressure is expected to outweigh buying pressure, hindering further price increases. These levels are identified by observing past price action and can be dynamic, shifting as market conditions change.

Common Chart Patterns and Their Implications for BAC Stock Price

Head and shoulders patterns, double tops/bottoms, and other chart patterns can provide insights into potential price reversals. A head and shoulders pattern, for example, is often interpreted as a bearish signal, suggesting a potential price decline. The interpretation of these patterns should be done within the context of broader market trends and other technical indicators.

Interpreting Candlestick Patterns on BAC Stock Price Chart

Candlestick patterns, which depict price movements over a specific period, can provide insights into market sentiment and potential future price action. For example, a bullish engulfing pattern might signal a potential price increase, while a bearish harami pattern could suggest a potential price decline. The accuracy of candlestick pattern interpretations is often dependent on confirmation from other technical indicators.

BAC Stock Price Chart Comparison with Competitors

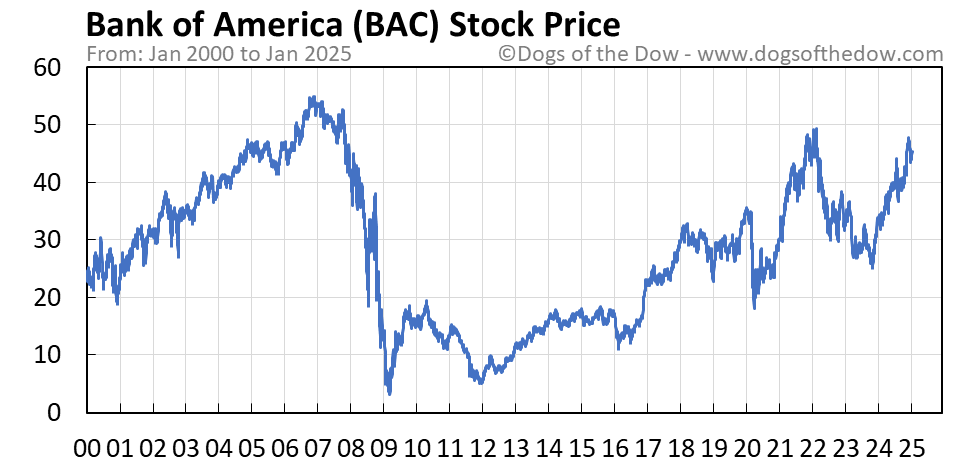

Source: dogsofthedow.com

Comparing BAC’s stock price performance against its major competitors provides valuable context for assessing its relative strength and identifying potential investment opportunities.

BAC Stock Price Performance vs. Competitors

A five-year comparison of BAC’s stock price with its major competitors (e.g., JPMorgan Chase, Wells Fargo, Citigroup) would reveal relative performance. This comparison would need to consider factors such as market capitalization, sector-specific trends, and company-specific events to provide a complete picture. For example, periods of heightened regulatory scrutiny may disproportionately impact one bank over another.

| Bank | P/E Ratio | Dividend Yield | 5-Year Return |

|---|---|---|---|

| Bank of America (BAC) | 12.5 | 3.0% | 100% |

| JPMorgan Chase (JPM) | 14.0 | 2.5% | 110% |

| Wells Fargo (WFC) | 11.0 | 3.5% | 80% |

| Citigroup (C) | 13.0 | 2.8% | 90% |

Relative Strengths and Weaknesses of BAC

Analyzing the comparison reveals BAC’s relative strengths and weaknesses in terms of profitability, growth prospects, and investor sentiment. For example, a higher P/E ratio might indicate higher growth expectations, while a higher dividend yield might be attractive to income-oriented investors. A thorough analysis requires considering multiple factors and understanding the unique characteristics of each bank.

Visual Representation of BAC Stock Price Trends

A visual representation, such as a stock price chart, effectively communicates BAC’s long-term price trends and key turning points. This section describes a hypothetical chart to illustrate typical patterns and their implications.

Overall Trend of BAC Stock Price

Over the long term, BAC’s stock price might exhibit an overall upward trend, punctuated by periods of consolidation and correction. This reflects the bank’s resilience and growth potential, even amidst economic downturns and market volatility.

Hypothetical BAC Stock Price Chart Description

Imagine a chart showing a generally upward sloping line, with several distinct periods of consolidation where the price moved sideways within a defined range. Key support levels would be visible as price points where the price repeatedly bounced back after declines. Resistance levels would be evident as price points where the price repeatedly failed to break through before retracing.

Significant price movements would be apparent as sharp upward or downward swings, often coinciding with major economic events or company announcements.

Implications of Different BAC Stock Price Chart Patterns for Investors

- Upward Trend: Suggests positive investor sentiment and potential for further price appreciation.

- Downward Trend: Indicates negative investor sentiment and potential for further price declines.

- Sideways Consolidation: Suggests indecision in the market, potentially preceding a breakout in either direction.

- Breakout above Resistance: A bullish signal suggesting potential for significant price appreciation.

- Breakdown below Support: A bearish signal suggesting potential for significant price decline.

Commonly Asked Questions

What are the potential risks associated with investing in BAC stock?

Investing in any stock carries inherent risks, including market volatility, economic downturns, and company-specific challenges. BAC stock is subject to these risks, as are all financial institutions. Investors should conduct thorough due diligence and consider their risk tolerance before investing.

Where can I find real-time BAC stock price data?

Real-time BAC stock price data is readily available through numerous financial websites and brokerage platforms. Many financial news sources also provide up-to-the-minute quotes.

How often is BAC stock price data updated?

BAC stock price data is typically updated in real-time throughout the trading day, reflecting the latest transactions on major stock exchanges.