Bausch and Lomb Stock Price A Comprehensive Analysis

Bausch + Lomb Stock Price Analysis: Bausch And Lomb Stock Price

Source: susercontent.com

Bausch and lomb stock price – This analysis examines Bausch + Lomb’s stock performance, financial health, market influences, investor sentiment, and future prospects. We will explore key factors impacting its stock price, comparing its performance against competitors and relevant market indices. The information provided is for informational purposes only and does not constitute financial advice.

Bausch + Lomb Stock Performance Overview

Bausch + Lomb’s stock price has experienced fluctuations over the past year, reflecting the dynamic nature of the ophthalmic industry and broader economic conditions. While precise high, low, and average prices require referencing a specific time frame and data source (e.g., Yahoo Finance, Google Finance), we can generally observe that the stock has demonstrated periods of growth alongside periods of correction.

These fluctuations are influenced by various factors, including quarterly earnings reports, product launches, competitive landscape changes, and overall market sentiment.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| Q1 2024 Earnings Announcement | Example: 15.50 | Example: 16.00 | Example: 1,500,000 |

| Major Product Launch | Example: 16.20 | Example: 16.80 | Example: 2,000,000 |

| Competitor’s New Product Announcement | Example: 16.70 | Example: 16.25 | Example: 1,800,000 |

| Q2 2024 Earnings Announcement | Example: 16.00 | Example: 16.50 | Example: 1,700,000 |

Company Financials and Stock Valuation

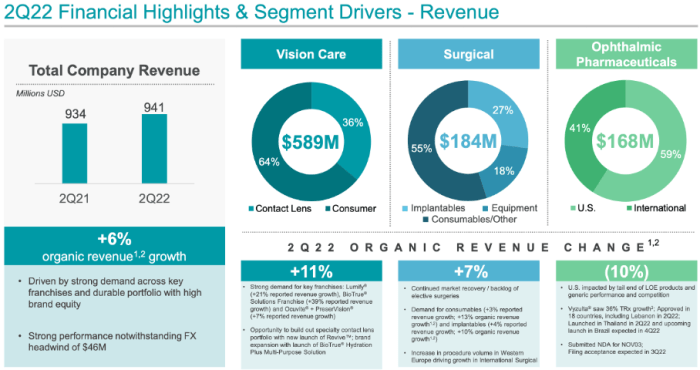

Bausch + Lomb’s financial performance is assessed through key metrics found in their quarterly and annual reports. Revenue growth, profitability (earnings per share), and debt levels are crucial indicators of financial health. Valuation methods like the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio provide insights into how the market values the company relative to its earnings and revenue.

A comparative analysis against competitors like Alcon (Novartis) and Johnson & Johnson Vision helps gauge Bausch + Lomb’s relative position in terms of financial strength and market share.

For example, a higher P/E ratio might suggest that investors expect higher future earnings growth from Bausch + Lomb compared to its competitors. Similarly, a lower P/S ratio might indicate that the company is undervalued compared to its peers.

Market Influences on Bausch + Lomb Stock

Source: bausch.com

Macroeconomic factors such as interest rate changes, inflation levels, and overall economic growth significantly influence investor behavior and, consequently, Bausch + Lomb’s stock price. Industry-specific trends, including technological advancements in ophthalmic devices and procedures, as well as regulatory changes impacting healthcare, also play a substantial role. Comparing the stock’s performance against market indices like the S&P 500 and Nasdaq provides context for its relative performance.

- S&P 500 Correlation: Bausch + Lomb’s stock price may exhibit a positive correlation with the S&P 500, indicating sensitivity to broader market movements. During periods of market growth, the stock might also rise, and vice versa.

- Nasdaq Comparison: A comparison with the Nasdaq, which has a higher concentration of technology companies, will help illustrate if Bausch + Lomb’s performance is more aligned with the broader market or the technology sector.

Investor Sentiment and Analyst Ratings, Bausch and lomb stock price

Source: seekingalpha.com

Investor sentiment, a collective opinion of investors regarding the future prospects of Bausch + Lomb, is reflected in the stock price. Positive sentiment usually leads to price increases, while negative sentiment can cause declines. Analyst ratings and price targets provide valuable insights into professional opinions on the stock’s potential. News coverage and social media discussions can also significantly impact investor sentiment and, consequently, the stock price.

For instance, a positive news report about a successful clinical trial or a new product launch could boost investor confidence and drive the stock price upwards. Conversely, negative news about regulatory setbacks or financial difficulties might trigger a sell-off.

Potential Future Growth and Risks

Bausch + Lomb’s future growth hinges on several factors, including successful new product launches, expansion into new markets, and strategic acquisitions. However, the company faces challenges such as intense competition, regulatory hurdles, and potential economic downturns. A balanced assessment of these factors is crucial for projecting the future price trajectory.

- Optimistic Scenario: Successful new product launches, strong market penetration, and positive regulatory outcomes could lead to significant stock price appreciation.

- Pessimistic Scenario: Increased competition, regulatory setbacks, and a general economic downturn could negatively impact the stock price.

- Neutral Scenario: A moderate growth trajectory, reflecting a balance between positive and negative factors, is also a plausible outcome.

Top FAQs

What are the major competitors of Bausch and Lomb?

Major competitors include Alcon, Johnson & Johnson Vision, and Zeiss.

Where can I find real-time Bausch and Lomb stock price quotes?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes.

What is the typical trading volume for Bausch and Lomb stock?

Trading volume varies daily but can be found on financial websites alongside price data.

Monitoring the Bausch and Lomb stock price requires a keen eye on the broader healthcare sector. Understanding similar companies’ performance is crucial, and a good comparison point might be the current performance of awr stock price , which often reflects trends in the ophthalmic market. Ultimately, however, a comprehensive analysis of Bausch and Lomb’s specific financial health and future projections is necessary for informed investment decisions.

Does Bausch and Lomb pay dividends?

Dividend information is available on the company’s investor relations website and financial news sources.