BCLI Stock Price A Comprehensive Analysis

Current Market Conditions and BCLI Stock Price

Bcli stock price – BCLI’s stock price is significantly influenced by prevailing macroeconomic conditions and industry-specific trends. Understanding these factors is crucial for assessing its current valuation and potential future performance. This section analyzes the interplay between these factors and BCLI’s stock price.

Macroeconomic Factors Impacting BCLI

Broad economic indicators such as inflation rates, interest rate adjustments, and overall economic growth directly affect BCLI’s valuation. High inflation, for instance, can increase BCLI’s operating costs, potentially squeezing profit margins and impacting investor confidence. Conversely, periods of strong economic growth often translate to increased demand for BCLI’s products or services, positively influencing revenue and stock price.

Industry-Specific Trends and BCLI’s Price Performance

The performance of BCLI’s stock is also influenced by trends specific to its industry. For example, changes in government regulations, technological advancements, or shifts in consumer preferences can all impact BCLI’s market share and profitability. Competitive pressures within the industry also play a significant role in shaping BCLI’s stock price.

BCLI’s Performance Compared to Competitors

A comparative analysis of BCLI’s performance against its main competitors provides valuable insights into its relative strength and market positioning. Key metrics such as revenue growth, market share, and profitability margins can be used to gauge BCLI’s competitiveness and its ability to outperform its rivals. Factors like innovation, brand recognition, and operational efficiency contribute to this comparative analysis.

Key Economic Indicators and Their Potential Effects on BCLI

| Indicator | Potential Effect on BCLI | Current Trend | Impact on Stock Price |

|---|---|---|---|

| Inflation Rate | Increased operating costs, reduced profit margins | (Insert current inflation rate data) | Potentially negative |

| Interest Rates | Impact on borrowing costs, investment decisions | (Insert current interest rate data) | Potentially positive or negative, depending on the rate change and BCLI’s debt levels |

| GDP Growth | Increased consumer spending, higher demand | (Insert current GDP growth data) | Potentially positive |

| Unemployment Rate | Affects consumer confidence and spending patterns | (Insert current unemployment rate data) | Potentially positive or negative, depending on the rate and industry sector |

BCLI’s Financial Performance and Stock Price

A thorough examination of BCLI’s financial statements reveals the relationship between its financial health and stock price fluctuations. This section delves into key financial metrics and their impact on investor sentiment.

Breakdown of BCLI’s Recent Financial Reports, Bcli stock price

BCLI’s recent financial reports should be analyzed, focusing on key metrics such as revenue, earnings per share (EPS), net income, and cash flow. Significant changes in these metrics compared to previous periods should be noted and their potential impact on the stock price discussed. For example, a significant increase in revenue accompanied by improved profit margins would generally be viewed positively by investors.

Revenue Growth and Stock Price Fluctuations

The correlation between BCLI’s revenue growth and its stock price movements needs to be explored. Consistent revenue growth, particularly if it outpaces industry averages, typically leads to a positive stock price reaction. However, other factors, such as increased competition or changes in investor sentiment, can also influence the relationship.

Profitability, Debt Levels, and Investor Sentiment

BCLI’s profitability and debt levels significantly influence investor perception. High profitability, coupled with manageable debt levels, generally attracts investors, leading to increased demand and higher stock prices. Conversely, declining profitability or high debt levels can negatively impact investor sentiment and depress the stock price.

Visual Representation of BCLI’s Financial Trends

| Year | Revenue (in millions) | EPS | Net Income (in millions) |

|---|---|---|---|

| (Insert Year) | (Insert Data) | (Insert Data) | (Insert Data) |

| (Insert Year) | (Insert Data) | (Insert Data) | (Insert Data) |

| (Insert Year) | (Insert Data) | (Insert Data) | (Insert Data) |

| (Insert Year) | (Insert Data) | (Insert Data) | (Insert Data) |

Investor Sentiment and Trading Activity

Understanding investor sentiment and trading activity provides valuable insights into the forces driving BCLI’s stock price. This section examines these factors and their correlation with price movements.

Factors Driving Investor Sentiment Towards BCLI

Investor sentiment towards BCLI is shaped by various factors, including its financial performance, industry outlook, management’s strategic decisions, and overall market conditions. Positive news releases, strong earnings reports, and indications of future growth potential tend to boost investor confidence, while negative news or disappointing financial results can lead to a decline in investor sentiment.

Trading Volume and its Correlation with Price Movements

Source: tradingview.com

Analyzing BCLI’s trading volume in relation to its price movements can reveal valuable information about market dynamics. High trading volume often accompanies significant price changes, suggesting strong investor interest and potentially increased volatility. Low trading volume, on the other hand, may indicate a lack of interest and potentially lower volatility.

BCLI’s Stock Price Performance Compared to Market Indices

Comparing BCLI’s stock price performance against relevant market indices (e.g., S&P 500, Nasdaq) helps assess its relative strength and volatility. Outperforming the market indices suggests that BCLI is performing well compared to its peers, while underperforming indicates potential challenges.

Visualization of Sentiment and Trading Activity Data

| Date | Trading Volume | Price Change | Investor Sentiment (Positive/Negative) |

|---|---|---|---|

| (Insert Date) | (Insert Data) | (Insert Data) | (Insert Data) |

| (Insert Date) | (Insert Data) | (Insert Data) | (Insert Data) |

| (Insert Date) | (Insert Data) | (Insert Data) | (Insert Data) |

BCLI’s Business Strategy and Future Outlook

BCLI’s current business strategy and long-term goals play a vital role in shaping investor expectations and influencing its stock price. This section Artikels BCLI’s strategic direction and assesses its potential future prospects.

Overview of BCLI’s Business Strategy and Long-Term Goals

A detailed overview of BCLI’s current business strategy, including its market positioning, competitive advantages, and long-term objectives, should be provided. This should include information on product development, market expansion plans, and any significant strategic partnerships or acquisitions.

Potential Risks and Opportunities Facing BCLI

An assessment of the potential risks and opportunities facing BCLI in the near future is crucial for understanding its future prospects. These could include factors such as economic downturns, increased competition, technological disruptions, or changes in regulatory environments. Opportunities might include new market entry, product innovation, or strategic alliances.

Management’s Plans to Enhance Shareholder Value

Management’s plans to enhance shareholder value are a key consideration for investors. This could involve initiatives such as cost-cutting measures, investments in research and development, share buybacks, or dividend increases. A clear communication strategy from management regarding these plans is important for maintaining investor confidence.

Key Aspects of BCLI’s Future Outlook

- Continued revenue growth driven by (mention specific factors)

- Expansion into new markets (mention target markets)

- Investment in research and development to enhance product offerings

- Focus on operational efficiency to improve profitability

- Potential risks related to (mention specific risks)

Technical Analysis of BCLI Stock Price

Technical analysis provides a framework for understanding BCLI’s past price movements and potentially predicting future trends. This section applies various technical indicators to BCLI’s historical stock price data.

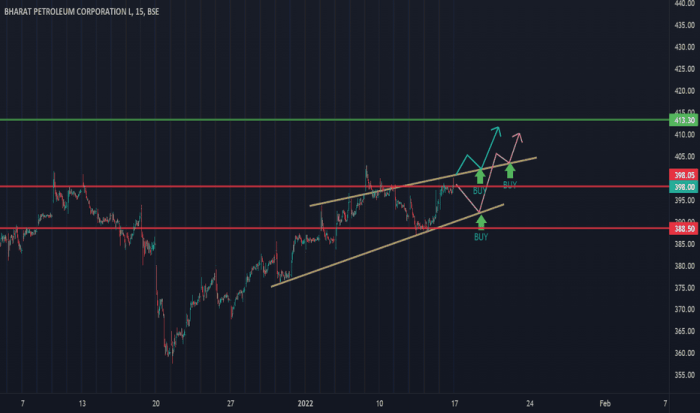

Application of Technical Indicators

Source: tradingview.com

Several technical indicators, such as moving averages (e.g., 50-day, 200-day), relative strength index (RSI), and MACD, can be applied to BCLI’s historical stock price data to identify trends, momentum, and potential turning points. For example, a rising 50-day moving average above a 200-day moving average is often interpreted as a bullish signal.

Potential Support and Resistance Levels

Identifying potential support and resistance levels is crucial in technical analysis. Support levels represent price points where buying pressure is expected to outweigh selling pressure, while resistance levels represent price points where selling pressure is expected to outweigh buying pressure. These levels can be identified by examining historical price charts and identifying areas of significant price consolidation or reversals.

Charting Techniques to Predict Future Price Movements

Various charting techniques, such as candlestick patterns, trend lines, and chart formations, can be used to predict potential future price movements. For example, a head and shoulders pattern is often considered a bearish reversal signal, suggesting a potential decline in price.

Description of a Relevant Candlestick Chart Pattern

The “hammer” candlestick pattern is a bullish reversal pattern characterized by a small real body at the bottom of the candle, with a long lower shadow (wick) and a relatively short upper shadow. The long lower shadow suggests that buying pressure emerged at lower price levels, potentially indicating a reversal of the downtrend. The small real body suggests indecision in the market, and the absence of a significant upper shadow suggests that selling pressure was limited.

The combination of these elements creates a bullish signal, suggesting a potential upward movement in price.

News and Events Impacting BCLI Stock Price

Significant news events and announcements often have a considerable impact on BCLI’s stock price. This section analyzes recent news and its effect on investor confidence and trading activity.

Recent News Events and Their Impact on BCLI’s Stock Price

Source: tradingview.com

Recent news events, such as earnings announcements, product launches, regulatory changes, or management changes, should be identified and their impact on BCLI’s stock price analyzed. For example, a positive earnings surprise often leads to a surge in the stock price, while negative news, such as a product recall or a regulatory setback, can cause a significant decline.

Impact of News Events on Investor Confidence and Trading Activity

The impact of news events on investor confidence and trading activity should be discussed. Positive news typically boosts investor confidence, leading to increased buying pressure and higher stock prices. Negative news, on the other hand, can erode investor confidence, leading to selling pressure and lower prices.

Market Reaction to Different Types of News

The market’s reaction to positive and negative news often differs. Positive news is usually met with increased buying pressure and a price increase, while negative news often leads to selling pressure and a price decline. The magnitude of the price reaction depends on several factors, including the severity of the news, the overall market sentiment, and the company’s financial health.

Timeline of Key News Events and Their Impact

| Date | Event | Impact on Stock Price | Investor Sentiment |

|---|---|---|---|

| (Insert Date) | (Insert Event) | (Insert Impact) | (Insert Sentiment) |

| (Insert Date) | (Insert Event) | (Insert Impact) | (Insert Sentiment) |

| (Insert Date) | (Insert Event) | (Insert Impact) | (Insert Sentiment) |

Essential FAQs

What are the major risks associated with investing in BCLI stock?

Investing in any stock carries inherent risks. For BCLI, potential risks could include decreased profitability, increased competition, changes in regulatory environments, and macroeconomic downturns. Thorough due diligence is essential before investing.

Where can I find real-time BCLI stock price data?

Real-time BCLI stock price data is typically available through major financial websites and brokerage platforms. These platforms often provide detailed charts, historical data, and news related to the stock.

How often does BCLI release financial reports?

The frequency of BCLI’s financial reports depends on its reporting schedule, which is typically quarterly and annually. Specific release dates are usually announced in advance and can be found on the company’s investor relations website.

What is the typical trading volume for BCLI stock?

Trading volume for BCLI stock fluctuates daily and can be found on financial websites and brokerage platforms. Factors like news events and market sentiment can significantly influence trading volume.