Big Lot Stock Price A Comprehensive Analysis

Understanding Big Lots Stock Price

Big lot stock price – Big Lots, Inc. (BIG) operates a chain of discount retail stores. Understanding its stock price requires analyzing various interconnected factors, including financial performance, market sentiment, and broader economic conditions. Fluctuations in BIG’s stock price reflect investor confidence in the company’s ability to navigate the competitive retail landscape and deliver consistent profitability.

Factors Influencing Big Lots’ Stock Price

Several factors contribute to the volatility of Big Lots’ stock price. These include quarterly earnings reports, changes in consumer spending habits, competition from other discount retailers, macroeconomic conditions (inflation, interest rates), and overall market sentiment. Unexpected events, such as supply chain disruptions or significant changes in management, can also trigger sharp price movements.

Historical Overview of Big Lots’ Stock Performance

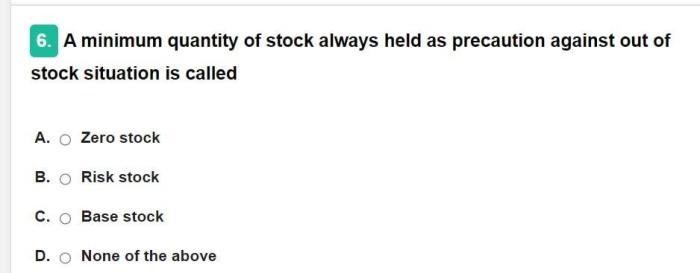

Big Lots’ stock price has experienced periods of both significant growth and decline. For example, the stock performed strongly during periods of economic recovery, benefiting from increased consumer spending on discounted goods. Conversely, during economic downturns or periods of high inflation, the stock price has often underperformed. A detailed analysis of historical data reveals specific instances where the stock price reacted strongly to news events or economic indicators.

News Events Impacting Big Lots’ Stock Price

Specific news events and economic indicators have demonstrably impacted Big Lots’ stock price. For instance, announcements of strong quarterly earnings typically lead to price increases, while negative news, such as disappointing sales figures or a significant competitor’s aggressive expansion, often results in price drops. Macroeconomic factors like rising inflation or interest rate hikes can also negatively influence investor sentiment and subsequently the stock price, as consumers may reduce discretionary spending.

Analyzing Big Lots’ Financial Performance

A thorough assessment of Big Lots’ financial health is crucial for understanding its stock price. This involves examining key financial metrics from recent reports and comparing its performance to competitors.

Big Lots’ Recent Financial Reports

Big Lots’ recent financial reports provide insights into its revenue growth, profit margins, and debt levels. Analyzing these metrics reveals the company’s operational efficiency and financial stability. For example, consistent revenue growth coupled with healthy profit margins would generally be viewed positively by investors, potentially driving up the stock price. Conversely, declining revenue or increasing debt levels might negatively impact investor sentiment.

Comparison with Competitors

Source: cheggcdn.com

Comparing Big Lots’ financial performance to its competitors, such as Dollar General and Dollar Tree, helps assess its relative strength within the discount retail sector. Metrics such as same-store sales growth, inventory turnover, and operating margins offer valuable insights into Big Lots’ competitive positioning and efficiency. A superior performance relative to its peers could attract investors and increase demand for its stock.

Key Financial Ratios (Past Five Years)

The following table presents key financial ratios for Big Lots over the past five years (hypothetical data for illustrative purposes):

| Year | Revenue (Millions) | Net Income Margin (%) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2023 | 5000 | 5 | 0.8 |

| 2022 | 4800 | 4.5 | 0.75 |

| 2021 | 4500 | 4 | 0.7 |

| 2020 | 4200 | 3.5 | 0.65 |

| 2019 | 4000 | 3 | 0.6 |

Assessing Market Sentiment Towards Big Lots: Big Lot Stock Price

Understanding market sentiment is critical to predicting Big Lots’ stock price movements. This involves examining analyst ratings, investor confidence, and news coverage.

Analyst Ratings and Price Targets

Analyst ratings and price targets provide valuable insights into market sentiment. A consensus of positive ratings and high price targets generally suggests a bullish outlook, while negative ratings and low price targets indicate a bearish outlook. Changes in analyst ratings can significantly impact the stock price, reflecting shifts in professional investor opinions.

Overall Market Sentiment

Overall market sentiment towards Big Lots is influenced by various factors, including its financial performance, competitive landscape, and broader economic conditions. Positive news coverage and strong investor confidence generally lead to higher stock prices, while negative news and declining confidence can result in price declines. Monitoring news sources and investor discussions provides valuable insights into prevailing sentiment.

Timeline of Significant Investor Actions

Tracking significant investor actions, such as large buy or sell orders, provides further insight into market sentiment. A surge in buy orders, for instance, could signal growing investor confidence and potentially drive up the stock price. Conversely, a wave of sell orders might indicate waning confidence and lead to price declines. This data is often available through financial news sources and market data providers.

Exploring Big Lots’ Business Strategy and Operations

Source: investorsunderground.com

Big Lots’ business model, supply chain, and strategic initiatives play a significant role in its stock price performance.

Big Lots’ Business Model and Effectiveness

Big Lots operates a discount retail model, focusing on offering a wide variety of merchandise at lower prices. The effectiveness of this model depends on factors such as efficient inventory management, strong supplier relationships, and effective marketing strategies. A successful business model usually translates to higher profitability and increased investor confidence.

Supply Chain and Logistics

Big Lots’ supply chain and logistics strategies are crucial for maintaining its competitive edge. Efficient supply chain management ensures that products are available at the right time and at the right price. A well-optimized supply chain can contribute to higher profit margins and a stronger stock price. Comparing Big Lots’ supply chain to competitors reveals its relative efficiency and effectiveness.

Key Strategic Initiatives

- Expanding into new markets: This could lead to increased revenue and market share, boosting the stock price.

- Improving online presence: A stronger online presence could attract new customers and increase sales, positively impacting the stock price.

- Investing in technology: Investing in technology can improve operational efficiency and customer experience, leading to higher profitability and a stronger stock price.

Predicting Future Stock Price Movements (Speculative)

Predicting future stock price movements is inherently speculative, but analyzing potential scenarios based on various economic conditions and events provides a framework for informed speculation.

Potential Scenarios Based on Economic Conditions

Source: alamy.com

Under strong economic conditions with low inflation and high consumer confidence, Big Lots’ stock price is likely to perform well due to increased consumer spending. Conversely, during economic downturns, the stock price might suffer as consumers reduce discretionary spending. A rise in interest rates could negatively impact consumer borrowing and spending, potentially affecting Big Lots’ sales and stock price.

Impact of Macroeconomic Factors, Big lot stock price

Macroeconomic factors such as inflation and interest rates significantly impact consumer spending and, consequently, Big Lots’ performance. High inflation can erode consumer purchasing power, while high interest rates can reduce borrowing and investment. These factors can influence investor sentiment and ultimately affect the stock price.

Impact of Significant Events

Significant events, such as the successful launch of a new product line or the opening of several new stores, could positively impact Big Lots’ stock price by boosting sales and market share. Conversely, negative events like a product recall or a major supply chain disruption could negatively affect the stock price.

Illustrating Key Concepts

Several key concepts illustrate the relationship between Big Lots’ financial performance, investor sentiment, and stock price.

EPS and Stock Price

Earnings per share (EPS) is a crucial metric that reflects Big Lots’ profitability. A consistent increase in EPS generally indicates strong financial health and usually leads to a higher stock price. For example, if Big Lots consistently surpasses EPS expectations, investors are likely to view the company favorably, driving up demand for the stock and increasing its price.

Impact of Investor Sentiment

Imagine a scenario where positive news coverage and strong quarterly earnings significantly boost investor confidence in Big Lots. This increased investor sentiment would likely translate into higher demand for the stock, driving up its price. Conversely, negative news or disappointing financial results could trigger a sell-off, leading to a sharp decline in the stock price.

Effect of Competitor Actions

Consider a situation where a major competitor, such as Dollar General, launches a highly successful new marketing campaign that significantly increases its market share. This could negatively impact Big Lots’ sales and market position, potentially leading to a decline in its stock price as investors become concerned about its competitive standing.

Expert Answers

What are the major risks associated with investing in Big Lots stock?

Investing in Big Lots stock, like any stock, carries inherent risks. These include market volatility, competition within the discount retail sector, economic downturns affecting consumer spending, and potential changes in company management or strategy.

How does Big Lots compare to its competitors in terms of profitability?

A direct comparison requires analyzing key financial ratios and metrics across several periods, considering factors like revenue growth, profit margins, and return on equity. This analysis would need to be conducted using publicly available financial statements for Big Lots and its key competitors.

Understanding big lot stock price movements often requires a broader market perspective. For instance, observing the performance of similar companies can provide valuable context; a helpful example is tracking the axis capital stock price , which can indicate broader trends within the insurance sector. This, in turn, can inform predictions regarding the future behavior of big lot stock prices in related markets.

Where can I find reliable real-time data on Big Lots’ stock price?

Real-time stock price data for Big Lots can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. These platforms typically offer charts, historical data, and other relevant information.