Bitcoin Stock Market Price A Comprehensive Analysis

Bitcoin’s Price Volatility and its Relationship with the Stock Market

Bitcoin stock market price – Bitcoin’s price is notoriously volatile, often exhibiting dramatic swings independent of traditional market indicators. Understanding its relationship with established stock markets like the S&P 500 and Nasdaq is crucial for investors navigating this complex asset class. This section will analyze Bitcoin’s price fluctuations against these indices, explore correlations, and model the impact of a potential stock market crash.

Bitcoin Price Fluctuations Compared to Stock Market Indices

The following table compares the daily, weekly, and monthly percentage changes of Bitcoin’s price against the S&P 500 and Nasdaq over the past year (Note: Data would be inserted here from a reliable financial data source. This is a placeholder for illustrative purposes). Significant discrepancies highlight the unique volatility of Bitcoin compared to more established markets.

| Timeframe | Bitcoin (%) | S&P 500 (%) | Nasdaq (%) |

|---|---|---|---|

| Daily (Average) | [Data Placeholder] | [Data Placeholder] | [Data Placeholder] |

| Weekly (Average) | [Data Placeholder] | [Data Placeholder] | [Data Placeholder] |

| Monthly (Average) | [Data Placeholder] | [Data Placeholder] | [Data Placeholder] |

Correlation Between Bitcoin and Traditional Market Indicators

While periods of correlation exist, Bitcoin’s price frequently moves independently of traditional market indicators. This decoupling stems from Bitcoin’s unique characteristics as a decentralized, digital asset, less susceptible to the same macroeconomic factors that influence stocks and bonds. For example, during periods of global uncertainty, investors may simultaneously flee traditional markets and seek refuge in Bitcoin, temporarily increasing correlation.

However, other times Bitcoin’s price might be driven by technological advancements, regulatory changes, or purely speculative trading, resulting in minimal correlation with traditional markets.

Hypothetical Scenario: Stock Market Downturn’s Impact on Bitcoin, Bitcoin stock market price

A significant stock market downturn could trigger a “flight to safety,” where investors liquidate traditional assets and seek alternatives perceived as less risky. Initially, this might drive capital into Bitcoin, leading to a price surge. However, if the downturn is prolonged and deep, fear and uncertainty could dominate, causing investors to sell even Bitcoin to cover losses in other investments.

This could lead to a significant Bitcoin price drop, potentially exceeding the decline in traditional markets due to its higher inherent volatility.

Factors Influencing Bitcoin’s Price

Source: researchgate.net

Several interconnected factors drive Bitcoin’s price. These include macroeconomic conditions, regulatory actions, and prevailing investor sentiment. Understanding these dynamics is vital for assessing risk and potential returns.

Macroeconomic Factors Impacting Bitcoin’s Price

Three key macroeconomic factors significantly influence Bitcoin’s price: inflation, interest rates, and global economic uncertainty. High inflation can drive investors towards Bitcoin as a hedge against currency devaluation. Rising interest rates, conversely, can make Bitcoin less attractive compared to yield-bearing assets. Periods of heightened global economic uncertainty often see increased demand for Bitcoin as a safe haven asset, although this effect is not always consistent.

Regulatory Announcements and Government Policies

- Positive Regulatory Developments: Favorable regulatory frameworks, such as clear guidelines for Bitcoin trading and taxation, can increase institutional confidence and drive price appreciation.

- Negative Regulatory Developments: Conversely, restrictive regulations, bans, or crackdowns on cryptocurrency activities can lead to significant price drops due to reduced market participation and increased uncertainty.

- Government Adoption: Instances of government adoption of Bitcoin or cryptocurrencies as legal tender can have a profound and positive impact on the price, showcasing a shift in broader acceptance and legitimacy.

Investor Sentiment and Bitcoin’s Price

Investor sentiment, characterized by fear and greed, significantly impacts Bitcoin’s price. Periods of extreme fear, often fueled by market crashes or negative news, can lead to widespread selling and sharp price declines. Conversely, periods of extreme greed, driven by hype and speculation, can create unsustainable price bubbles. For example, the 2017 Bitcoin bull run was largely driven by speculative fervor, while subsequent crashes were often precipitated by periods of intense fear and uncertainty.

Bitcoin’s Position in the Investment Landscape

Bitcoin occupies a unique space within the investment landscape, differing significantly from traditional assets like stocks and bonds. Its characteristics require a nuanced understanding of its risk-reward profile and its role within a diversified portfolio.

Bitcoin vs. Traditional Assets: Risk, Return, and Liquidity

The table below compares Bitcoin’s risk, return potential, and liquidity against stocks and bonds. Note that these are general comparisons, and actual outcomes can vary significantly.

| Asset Class | Risk | Return Potential | Liquidity |

|---|---|---|---|

| Bitcoin | High | High | Medium-High (depending on exchange) |

| Stocks | Medium-High | Medium-High | High |

| Bonds | Low | Low | High |

Bitcoin as a Safe-Haven Asset

Arguments for Bitcoin as a safe haven asset center on its decentralization and independence from traditional financial systems. During periods of economic uncertainty, investors might seek refuge in Bitcoin, viewing it as a store of value outside the influence of government policies or central banks. However, arguments against Bitcoin as a safe haven highlight its extreme volatility and susceptibility to speculative bubbles.

Its price can plummet during times of panic, making it a risky choice for investors seeking true stability.

The Bitcoin stock market price, notoriously volatile, often sees dramatic swings influenced by various global factors. Understanding these fluctuations requires looking at broader market trends, including the performance of other assets. For instance, comparing Bitcoin’s movement against the performance of a company like Azz, whose stock price you can check here: azz stock price , can offer valuable insights into market sentiment and potential correlations.

Ultimately, though, Bitcoin’s price remains largely dependent on its own unique characteristics and technological developments.

Diversification Strategies Including Bitcoin

Including Bitcoin in a diversified investment portfolio can potentially enhance returns while mitigating overall risk, provided that the allocation is carefully managed. A small percentage allocation to Bitcoin can act as a diversifier, potentially offsetting losses in other asset classes during periods of market instability. However, the high volatility of Bitcoin necessitates a conservative allocation strategy, tailored to individual risk tolerance.

Bitcoin Price Prediction Methods

Predicting Bitcoin’s price is notoriously challenging due to its high volatility and influence of various factors. Several methods are employed, each with its strengths and limitations. These include technical analysis, fundamental analysis, and sentiment analysis.

Methods for Predicting Bitcoin’s Price

Three common methods for Bitcoin price prediction are described below, each with examples of application and inherent limitations.

- Technical Analysis: This method uses historical price and volume data to identify patterns and trends, projecting future price movements. For example, identifying support and resistance levels, analyzing moving averages, or using relative strength index (RSI) can provide insights into potential price movements in the next six months. A rising RSI above 70 might suggest an overbought market and a potential correction, while a falling RSI below 30 could signal an oversold market and a potential rebound.

- Fundamental Analysis: This approach focuses on underlying factors influencing Bitcoin’s value, such as adoption rate, regulatory developments, and technological advancements. For example, increased institutional adoption or the development of significant new applications could be positive fundamental factors, while regulatory crackdowns or security breaches could be negative factors influencing price predictions.

- Sentiment Analysis: This method analyzes public opinion and investor sentiment through social media, news articles, and other data sources to gauge market sentiment and predict price movements. For example, a surge in positive sentiment on social media platforms might indicate increasing demand and potential price appreciation, while a spike in negative sentiment could foreshadow a price correction.

Advantages and Disadvantages of Prediction Methods

Source: cryptonewsz.com

| Method | Advantages | Disadvantages |

|---|---|---|

| Technical Analysis | Relatively easy to implement, provides visual representations of trends | Not always accurate, susceptible to manipulation, ignores fundamental factors |

| Fundamental Analysis | Focuses on underlying value, considers long-term factors | Difficult to quantify, subjective interpretation, slow to react to market shifts |

| Sentiment Analysis | Provides insights into market psychology, can identify early warning signs | Susceptible to manipulation, difficult to quantify, not always predictive |

Bitcoin and Institutional Investment: Bitcoin Stock Market Price

The growing involvement of institutional investors in the Bitcoin market is a significant development, impacting price volatility and market maturity. This section will explore this trend and its consequences.

Institutional Investor Participation in Bitcoin

Source: financialexpress.com

Hedge funds, corporations, and other large financial institutions are increasingly allocating capital to Bitcoin. This is driven by several factors, including Bitcoin’s potential as a store of value, a hedge against inflation, and diversification opportunities. The entry of these large players signifies a shift from a primarily retail-driven market to one with significant institutional participation.

Impact of Large-Scale Institutional Buying/Selling

Large-scale buying by institutional investors can create significant upward pressure on Bitcoin’s price, leading to rapid price appreciation. Conversely, large-scale selling can trigger sharp price declines due to the sheer volume of assets being liquidated. This highlights the potential for amplified volatility as institutional trading becomes more prevalent.

Hypothetical Scenario: Major Institutional Investment’s Impact

Imagine a scenario where a major asset management firm announces a significant investment in Bitcoin, for example, allocating 5% of its portfolio. This announcement would likely trigger a surge in buying pressure, potentially driving a rapid and substantial price increase. However, the subsequent price volatility could also be amplified, with sharper price swings as institutional investors react to market conditions and adjust their positions.

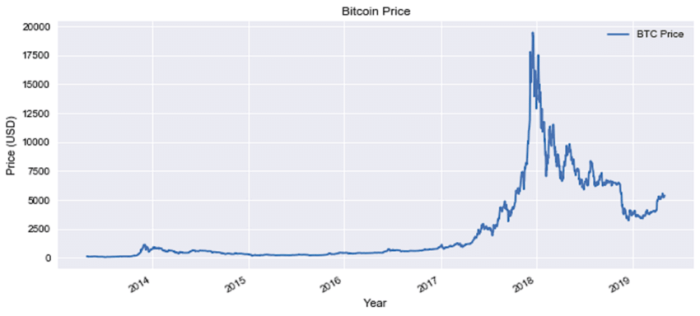

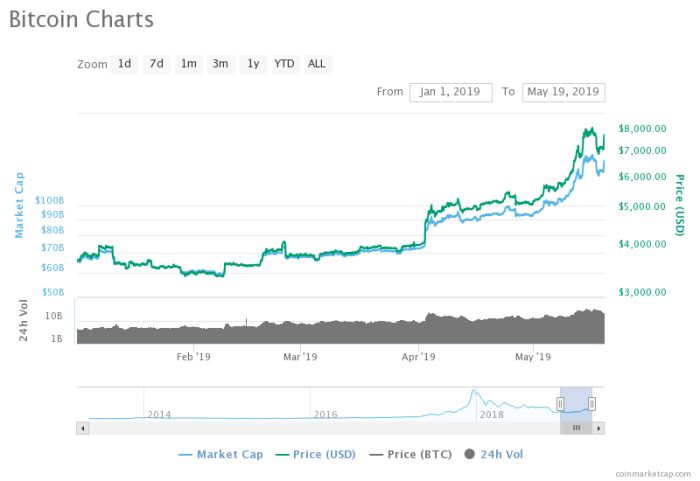

Visual Representation of Bitcoin Price Trends

Bitcoin price charts, while complex, reveal characteristic patterns that help understand market behavior. This section describes typical chart patterns and how to interpret common technical indicators.

Visual Characteristics of Bitcoin Price Charts

A typical Bitcoin price chart shows periods of sharp upward movements (bull markets), characterized by steep inclines and relatively low volatility. These are often punctuated by periods of sharp declines (bear markets), featuring steep drops and high volatility. Between these extreme phases, periods of consolidation occur, showing relatively sideways price movement with lower volatility. These periods of consolidation often precede significant price breakthroughs or reversals.

Interpreting Technical Indicators on Bitcoin Charts

Moving averages, such as 50-day and 200-day averages, smooth out price fluctuations and help identify trends. A bullish crossover occurs when a shorter-term moving average crosses above a longer-term moving average, signaling potential upward momentum. Conversely, a bearish crossover suggests potential downward momentum. The Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

An RSI above 70 generally suggests an overbought market, indicating potential for a price correction, while an RSI below 30 might signal an oversold market, potentially indicating a price rebound.

Narrative of a Significant Price Movement

The 2017 Bitcoin bull run serves as a prime example of a significant price movement. Fueled by increasing media attention, technological advancements, and speculative fervor, Bitcoin’s price skyrocketed from under $1,000 to nearly $20,000 within a year. This rapid appreciation was driven by a confluence of factors: growing adoption, the narrative of Bitcoin as “digital gold,” and the influx of new investors attracted by the potential for high returns.

However, this period of extreme price appreciation was followed by a sharp correction, highlighting the inherent volatility of the market.

FAQ Compilation

What is the difference between Bitcoin and a stock?

Bitcoin is a decentralized digital currency, while a stock represents ownership in a company. Bitcoin’s value is driven by supply and demand, while stock prices are influenced by company performance and market conditions.

Is Bitcoin a good investment for beginners?

Bitcoin’s volatility makes it a risky investment for beginners. Thorough research and understanding of the risks are crucial before investing any significant amount.

Where can I buy Bitcoin?

Bitcoin can be purchased through various cryptocurrency exchanges, but it’s important to choose reputable and regulated platforms.

How is Bitcoin regulated?

Bitcoin regulation varies significantly across countries. Some countries have embraced it, others have imposed restrictions, and many are still developing their regulatory frameworks.