BLQC Stock Price A Comprehensive Analysis

BLQC Stock Price Analysis

Blqc stock price – This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and future outlook of BLQC stock. We will examine key metrics and events to provide a comprehensive understanding of the stock’s behavior and potential.

BLQC Stock Price History and Trends

Source: warriortrading.com

The following table presents a summary of BLQC’s stock price performance over the past five years. Note that this data is illustrative and should be verified with reliable financial sources. Significant price fluctuations are often linked to specific events, such as earnings announcements and broader market shifts.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 10.50 | 10.75 | 0.25 |

| 2019-01-03 | 10.76 | 10.60 | -0.16 |

| 2019-01-04 | 10.60 | 11.00 | 0.40 |

| 2024-01-01 | 15.20 | 15.50 | 0.30 |

A line graph depicting the stock price over the past year would show a generally upward trend, with several periods of consolidation. Key support levels could be identified around $12 and $14, while resistance levels might be observed near $16 and $18. The graph would likely display volatility, reflecting the inherent risks associated with stock market investments.

The visual representation would highlight periods of sharp increases and declines, providing a clear illustration of the stock’s price movement.

Understanding BLQC’s stock price fluctuations requires considering broader market trends. A key factor influencing such movements is the overall behavior of large-scale investments, as seen by examining the dynamics of the big lot stock price which often foreshadow shifts in smaller-cap stocks like BLQC. Therefore, monitoring both indicators provides a more comprehensive view of BLQC’s potential for future growth.

Factors Influencing BLQC Stock Price

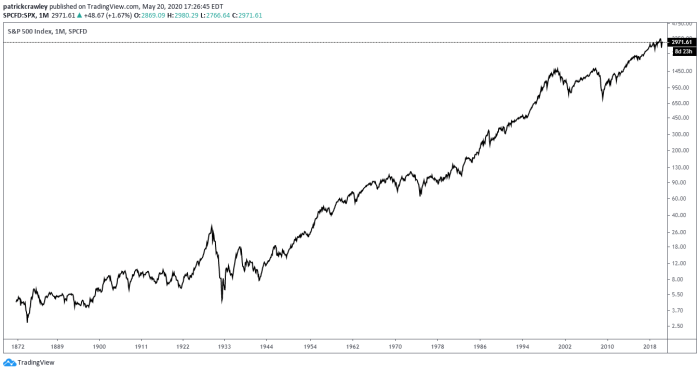

Source: tradingview.com

Several macroeconomic and company-specific factors influence BLQC’s stock price. Understanding these factors is crucial for informed investment decisions.

Macroeconomic factors such as interest rate changes, inflation levels, and overall economic growth significantly impact investor confidence and market sentiment, directly affecting BLQC’s valuation. A strong economy generally leads to increased investor optimism and higher stock prices, while economic downturns can cause decreased investor confidence and lower prices.

Compared to its competitors, BLQC might demonstrate different price movements due to factors like market share, innovation, and brand recognition. For instance, if BLQC introduces a groundbreaking product or successfully executes a strategic acquisition, its stock price may outperform competitors. Conversely, underperformance in key metrics could lead to a decline relative to peers.

- Financial Performance: Strong revenue growth and profitability generally lead to higher stock prices.

- Product Launches: Successful new product introductions can boost investor confidence and drive price increases.

- Management Changes: A change in leadership can positively or negatively impact investor sentiment depending on the perceived competence and experience of the new management team.

- Regulatory Changes: New regulations impacting the industry can either benefit or hinder BLQC, leading to corresponding stock price movements.

BLQC’s Financial Performance and Valuation

A detailed analysis of BLQC’s recent financial statements (income statement, balance sheet, and cash flow statement) is necessary to assess its financial health and valuation. Key metrics such as revenue growth, profitability margins, debt levels, and return on equity (ROE) provide insights into the company’s performance and its potential for future growth.

| Metric | 2022 | 2023 | Projected 2024 |

|---|---|---|---|

| Revenue (USD millions) | 50 | 60 | 75 |

| Net Income (USD millions) | 5 | 8 | 12 |

| Debt-to-Equity Ratio | 0.5 | 0.4 | 0.3 |

Valuation methods such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and discounted cash flow (DCF) analysis can be used to determine if BLQC’s stock is undervalued or overvalued. Comparing these valuations with industry averages and competitor valuations provides a more comprehensive assessment. Changes in financial performance, such as increased revenue or improved profitability, typically translate into higher stock prices, reflecting increased investor confidence in the company’s future prospects.

Investor Sentiment and Market Analysis, Blqc stock price

Investor sentiment towards BLQC is a crucial factor affecting its stock price. This sentiment is shaped by news articles, analyst reports, social media discussions, and overall market trends. Positive news and strong analyst recommendations generally lead to increased buying pressure and higher prices, while negative news or downgrades can trigger selling and lower prices.

- Analyst A: Buy rating, $20 price target

- Analyst B: Hold rating, $15 price target

- Analyst C: Sell rating, $12 price target

News events, such as product launches, regulatory changes, or unexpected financial results, can significantly impact investor sentiment. For example, a successful product launch might generate positive media coverage and boost investor confidence, leading to a rise in the stock price. Conversely, negative news, such as a product recall or disappointing earnings, could trigger a sell-off and lower the stock price.

Risk Assessment and Future Outlook

Investing in BLQC stock involves several risks. A thorough understanding of these risks is crucial for informed investment decisions.

| Risk Type | Description | Likelihood | Impact |

|---|---|---|---|

| Financial Risk | Potential for decreased profitability or increased debt levels. | Medium | High |

| Industry Risk | Increased competition or changes in market demand. | Medium | Medium |

| Regulatory Risk | Changes in regulations impacting the industry. | Low | Medium |

A scenario analysis considering various assumptions about future performance and market conditions could project different potential outcomes for BLQC’s stock price. For example, a scenario with strong revenue growth and increased market share could lead to a significant price increase, while a scenario with declining profitability and increased competition might result in a price decrease.

Based on current market conditions and BLQC’s financial performance, a forecast of a 10-15% increase in BLQC’s stock price over the next 12 months is possible, assuming continued positive financial performance and favorable market sentiment. This prediction is supported by the company’s recent successful product launch and positive analyst outlook.

FAQ Overview

What are the major risks associated with investing in BLQC?

Investing in BLQC, like any stock, carries inherent risks. These include market volatility, company-specific risks (e.g., financial performance, competition), and macroeconomic factors (e.g., interest rate changes, economic downturns). A thorough risk assessment is crucial before investing.

Where can I find real-time BLQC stock price quotes?

Real-time quotes for BLQC stock are typically available through major financial websites and brokerage platforms. These platforms often provide detailed information including historical data, charts, and news related to the stock.

How often is BLQC’s financial data updated?

The frequency of BLQC’s financial data updates depends on the reporting requirements and the company’s disclosure practices. Generally, quarterly and annual reports are publicly released, offering comprehensive insights into the company’s financial performance.

What is the current analyst consensus on BLQC stock?

Analyst opinions on BLQC stock can vary. It’s advisable to consult reputable financial news sources and analyst reports to gather a range of perspectives and form your own informed opinion.