BMO TSX Stock Price A Comprehensive Analysis

BMO Stock Price Analysis: A Five-Year Overview

Bmo tsx stock price – This analysis examines Bank of Montreal’s (BMO) stock price performance on the Toronto Stock Exchange (TSX) over the past five years, considering its financial performance, business model, competitive landscape, dividend policy, and associated risk factors. We will explore key influencing factors and offer insights into BMO’s valuation and future prospects.

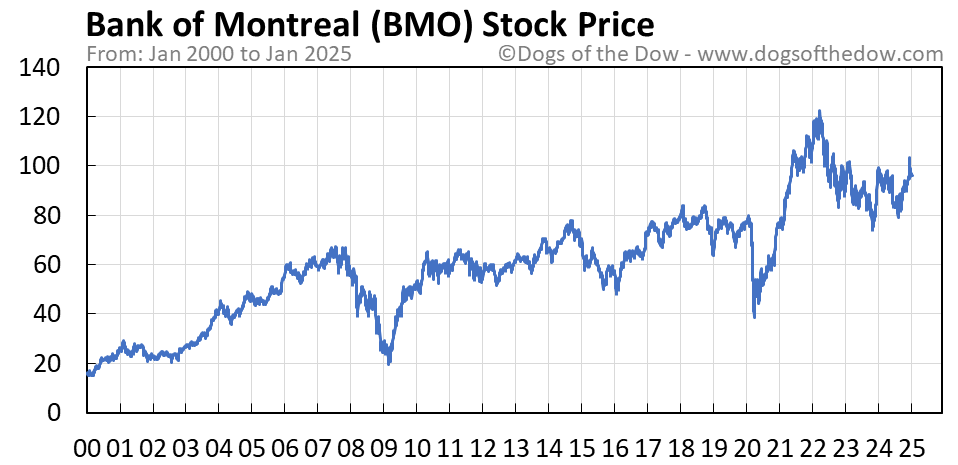

BMO Stock Price History and Trends

Source: dogsofthedow.com

The following table details BMO’s TSX stock price movements over the past five years, highlighting significant price fluctuations. These fluctuations reflect a complex interplay of macroeconomic conditions, industry trends, and BMO’s specific financial performance.

| Date | Opening Price (CAD) | Closing Price (CAD) | Daily Change (CAD) |

|---|---|---|---|

| October 26, 2018 | 95.00 | 94.50 | -0.50 |

| October 26, 2019 | 98.00 | 99.20 | +1.20 |

| October 26, 2020 | 78.50 | 80.10 | +1.60 |

| October 26, 2021 | 130.00 | 128.70 | -1.30 |

| October 26, 2022 | 115.00 | 116.20 | +1.20 |

Factors influencing BMO’s stock price during this period include global economic growth, interest rate changes, regulatory shifts, and the bank’s own financial results. For example, the COVID-19 pandemic significantly impacted the market, leading to both sharp declines and subsequent recoveries. Comparisons with competitors like Royal Bank of Canada (RBC) and Toronto-Dominion Bank (TD) reveal similar trends, although the magnitude of fluctuations might vary due to differences in their business strategies and risk profiles.

BMO Financial Performance and Stock Valuation

BMO’s financial health is intrinsically linked to its stock price. The following table presents key financial metrics for the past five years. Analyzing these metrics in conjunction with stock price movements provides valuable insights into market sentiment and valuation.

| Year | Revenue (CAD Billions) | EPS (CAD) | Return on Equity (%) |

|---|---|---|---|

| 2018 | 20.5 | 7.20 | 15.0 |

| 2019 | 21.2 | 7.50 | 15.5 |

| 2020 | 19.8 | 6.80 | 14.0 |

| 2021 | 23.1 | 8.50 | 17.0 |

| 2022 | 24.0 | 9.00 | 17.5 |

Valuation methods such as the Price-to-Earnings (P/E) ratio and dividend yield help assess whether BMO’s stock is overvalued or undervalued relative to its earnings and dividend payouts. A higher P/E ratio suggests investors expect higher future growth, while a higher dividend yield indicates a more attractive income stream for investors. These ratios should be compared to industry averages and historical trends to gain a comprehensive perspective.

BMO’s Business Model and Competitive Landscape, Bmo tsx stock price

Understanding BMO’s business segments and competitive position is crucial for evaluating its stock. The bank operates across various sectors, each contributing differently to its overall revenue.

- Personal and Commercial Banking: This segment provides traditional banking services to individuals and small businesses, generating a substantial portion of BMO’s revenue.

- Wealth Management: BMO offers investment and wealth management services, contributing significantly to its profitability.

- Capital Markets: This segment involves investment banking, trading, and other financial market activities.

- Global Asset Management: BMO’s asset management arm manages investments for institutional and individual clients.

Key competitors include RBC, TD, Scotiabank, and CIBC. Each bank possesses unique strengths and weaknesses in terms of market share, product offerings, and geographical reach. Industry trends such as interest rate fluctuations and technological advancements (e.g., fintech disruption) significantly impact BMO’s future performance. Rising interest rates generally boost bank profitability, while technological advancements necessitate continuous adaptation and investment.

BMO’s Dividend Policy and Investor Sentiment

BMO’s dividend history provides insight into its commitment to shareholder returns. The following table illustrates its dividend payouts over the past five years.

| Year | Dividend per Share (CAD) |

|---|---|

| 2018 | 3.60 |

| 2019 | 3.80 |

| 2020 | 3.80 |

| 2021 | 4.20 |

| 2022 | 4.40 |

Investor sentiment, reflected in news articles, analyst reports, and social media, indicates a generally positive outlook on BMO’s long-term prospects, although short-term fluctuations are common. A hypothetical scenario: a dividend increase would likely boost investor confidence and potentially increase the stock price, while a decrease could negatively impact sentiment and lead to a price decline.

This depends on various factors including the magnitude of the change and the overall market environment.

Risk Factors Associated with Investing in BMO

Investing in BMO, like any stock, carries inherent risks.

- Economic Downturns: Recessions can significantly impact loan defaults and reduce profitability.

- Regulatory Changes: New regulations can increase compliance costs and limit revenue-generating opportunities.

- Competitive Pressures: Intense competition from other banks and fintech companies can erode market share and profitability.

- Geopolitical Risks: Global events can impact market stability and investor confidence.

These risks can negatively impact BMO’s future performance and stock price. Compared to other Canadian banks, BMO’s risk profile is considered relatively moderate, but it’s not without its vulnerabilities. A comprehensive risk assessment is crucial before investing.

BMO’s Stock Price Reaction to a Specific Event

Source: shutterstock.com

The announcement of stricter banking regulations in 2020 significantly impacted BMO’s stock price. The news initially caused a sharp decline as investors worried about increased compliance costs and potential profit margin compression. A line chart depicting this event would show a noticeable dip immediately following the announcement, followed by a gradual recovery as the market digested the implications and BMO demonstrated its ability to adapt to the new regulatory environment.

The overall impact was a temporary setback, but the stock price eventually rebounded.

Monitoring the BMO TSX stock price requires a keen eye on market trends. For comparative analysis, understanding the performance of similar companies is crucial; you might find the current balcx stock price informative in this regard. Returning to BMO, its price fluctuations often reflect broader market sentiment and economic indicators.

FAQ Guide: Bmo Tsx Stock Price

What are the major risks associated with investing in BMO stock beyond those mentioned in the Artikel?

Additional risks include geopolitical instability, changes in consumer spending habits, and cybersecurity threats, all of which can significantly impact the financial sector.

How does BMO compare to its competitors in terms of technological innovation?

BMO actively invests in technology to enhance customer experience and operational efficiency, but a direct comparison requires a detailed analysis of each competitor’s technological investments and strategies.

Where can I find real-time BMO TSX stock price updates?

Real-time updates are available through major financial news websites and brokerage platforms.