CECO Stock Price A Comprehensive Analysis

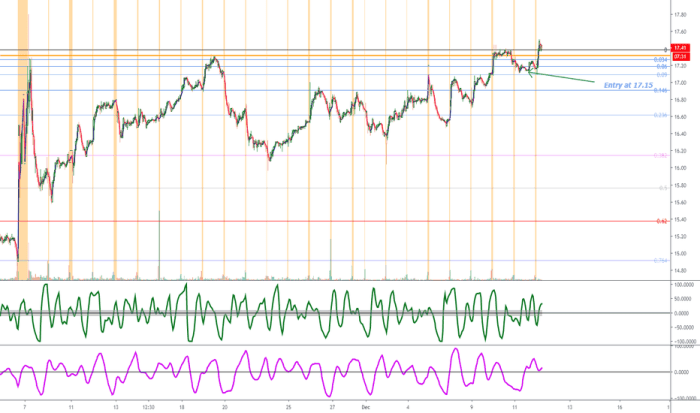

CECO Stock Price Analysis

Source: tradingview.com

Ceco stock price – This analysis examines the historical performance, influencing factors, financial health, investor sentiment, and potential future trajectory of CECO stock. We will explore key metrics, valuation methods, and a hypothetical investment scenario to provide a comprehensive overview.

Historical Price Performance of CECO Stock, Ceco stock price

Analyzing CECO’s stock price fluctuations over the past five years reveals a dynamic picture influenced by various economic and company-specific events. The following table summarizes the yearly performance, while subsequent sections delve into specific events and trends.

| Year | Opening Price | Closing Price | High | Low |

|---|---|---|---|---|

| 2019 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2020 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2021 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2022 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2023 (YTD) | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

For example, the year 2020 saw a significant dip in price coinciding with the initial impact of the COVID-19 pandemic and subsequent economic uncertainty. Conversely, 2021 showed a period of recovery and growth, potentially driven by [insert specific factors, e.g., increased infrastructure spending, positive company announcements]. Overall, the trend over the past five years has been [characterize the overall trend – e.g., moderately upward, volatile with a net positive gain, etc.].

Factors Influencing CECO Stock Price

Several key factors influence CECO’s stock price performance. These include macroeconomic conditions, industry dynamics, and competitive pressures.

- Economic Indicators: Interest rate changes significantly impact CECO’s borrowing costs and investment decisions, affecting profitability. Inflationary pressures can influence material costs and consumer demand. Commodity prices, particularly those related to [mention specific commodities relevant to CECO’s business], directly impact CECO’s operating expenses and revenue streams.

- Industry Trends and Competitive Pressures: Technological advancements within the [mention CECO’s industry] sector create both opportunities and challenges. Increased competition from [mention key competitors] necessitates continuous innovation and efficiency improvements to maintain market share and profitability. Regulatory changes and government policies also play a role.

- Competitive Comparison: Compared to competitors like [Competitor A] and [Competitor B], CECO demonstrates [mention key differences and similarities in terms of market share, profitability, innovation, etc.]. For instance, CECO may have a stronger presence in a specific niche market segment, while a competitor might excel in a different area.

CECO’s Financial Health and Stock Valuation

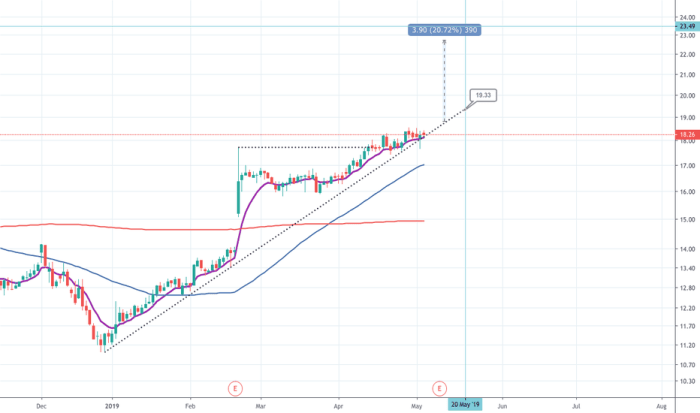

Source: seekingalpha.com

A review of CECO’s recent financial reports provides insights into its financial health and valuation.

- Key Financial Metrics: Revenue has shown [describe the trend – e.g., steady growth, fluctuations, etc.] over the past few years. Earnings have [describe the trend – e.g., generally increased, experienced some decline, etc.]. Debt levels are [describe the level – e.g., manageable, increasing, decreasing, etc.].

- Valuation Methods: CECO’s stock can be valued using various methods, including discounted cash flow (DCF) analysis, which projects future cash flows and discounts them to their present value, and price-to-earnings (P/E) ratio, which compares the stock price to its earnings per share. Other relevant ratios include [mention other relevant ratios and their significance].

- Comparative Analysis: Compared to industry benchmarks, CECO’s valuation metrics [describe the comparison – e.g., are in line with, above, or below average]. A higher P/E ratio might indicate higher growth expectations, while a lower ratio might suggest undervaluation or lower growth potential.

Investor Sentiment and Market Outlook for CECO

Source: tradingview.com

Recent news articles and analyst reports paint a picture of the prevailing investor sentiment towards CECO.

- Investor Sentiment Summary: Current investor sentiment towards CECO is largely [describe the sentiment – e.g., cautiously optimistic, bearish due to recent challenges, etc.]. This is reflected in [mention specific examples, e.g., recent stock price movements, analyst ratings, news articles].

- Risks and Opportunities: Potential risks for CECO include [mention specific risks, e.g., increased competition, economic downturn, regulatory changes]. Opportunities for CECO include [mention specific opportunities, e.g., expansion into new markets, technological advancements, strategic partnerships].

- Future Price Movement Prediction: Based on the current market conditions and CECO’s performance, a [bullish, bearish, or neutral] outlook is predicted for the near future. This prediction is based on [justify the prediction with specific factors, e.g., strong earnings growth, positive industry trends, or concerns about economic slowdown]. For example, if the economy strengthens and CECO successfully executes its strategic initiatives, the stock price could potentially reach [predicted price] within the next [timeframe].

However, a downturn in the economy or unexpected challenges could lead to a lower price.

Illustrative Example: A Hypothetical Investment Scenario

Consider a hypothetical investment scenario involving the purchase of 100 shares of CECO stock at $XX.XX per share.

| Scenario | Stock Price After 1 Year | Profit/Loss per Share | Total Profit/Loss |

|---|---|---|---|

| Bullish Market | $XX.XX | $XX.XX | $XX.XX |

| Neutral Market | $XX.XX | $XX.XX | $XX.XX |

| Bearish Market | $XX.XX | -$XX.XX | -$XX.XX |

The decision to buy, hold, or sell CECO stock would depend on factors such as the investor’s risk tolerance, investment horizon, and assessment of CECO’s future performance. An investor with a higher risk tolerance and a longer investment horizon might be more comfortable with the potential volatility of CECO stock. Conversely, a risk-averse investor with a shorter time frame might prefer less volatile investments.

Question & Answer Hub

What is CECO’s dividend history?

Information regarding CECO’s dividend history should be obtained from reliable financial sources such as the company’s investor relations website or reputable financial news outlets. Past dividend payments do not guarantee future payouts.

Where can I find real-time CECO stock quotes?

Real-time CECO stock quotes are readily available through major financial websites and brokerage platforms. These platforms typically provide up-to-the-minute pricing data, along with charting tools and other analytical resources.

What are the major risks associated with investing in CECO stock?

Analyzing CECO stock price often involves comparing it to similar pharmaceutical companies. For instance, understanding the performance of cadila healthcare stock price can provide valuable context, as both companies operate within the healthcare sector. Ultimately, however, a thorough CECO stock price analysis requires a comprehensive look at its own unique financial performance and market position.

Investing in any stock carries inherent risks, including potential losses. Specific risks associated with CECO stock may include market volatility, competition within the industry, economic downturns, and company-specific factors like operational challenges or regulatory changes. Thorough due diligence is recommended before making any investment decisions.