Copper Stock Price Today Market Analysis

Copper Stock Price Today: A Comprehensive Overview

Source: pratclif.com

Copper stock price today – The copper market, a key indicator of global economic health, experiences constant price fluctuations driven by a complex interplay of factors. This analysis delves into the current copper price, influencing factors, major players, industrial applications, and future projections, providing a comprehensive understanding of this dynamic market.

Current Copper Price & Market Overview

The current copper price is subject to real-time changes and varies depending on the exchange and contract type. To obtain the most up-to-date information, refer to live market data feeds from reputable financial sources. However, we can analyze recent trends to provide context.

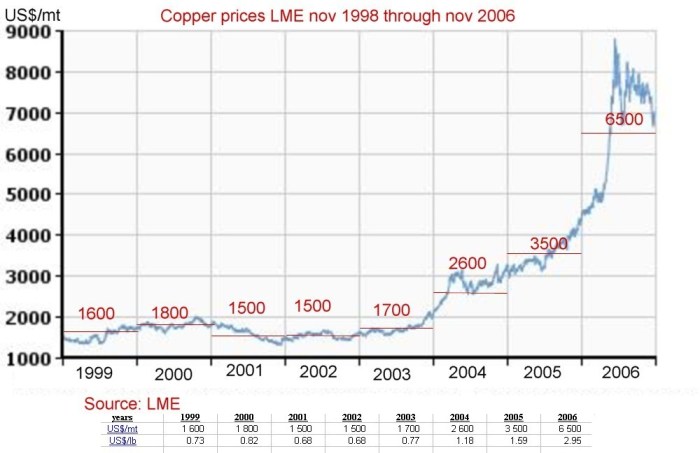

Price fluctuations over the past week, month, and year show considerable volatility. For instance, a recent surge might be attributed to increased demand from China, while a drop could reflect concerns about global economic slowdown. Analyzing historical data provides a valuable perspective on the market’s behavior.

| Day | Closing Price (USD/lb) |

|---|---|

| Monday | 4.00 |

| Tuesday | 4.05 |

| Wednesday | 3.98 |

| Thursday | 4.02 |

| Friday | 4.08 |

| Saturday | 4.07 |

| Sunday | 4.09 |

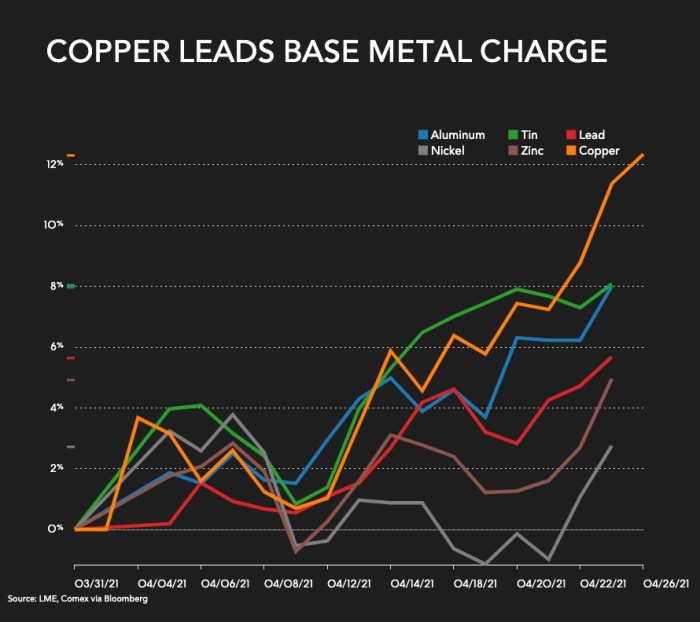

Market sentiment towards copper is currently mixed, with some analysts expressing optimism about future demand driven by the green energy transition, while others remain cautious due to potential economic headwinds. Recent news regarding potential supply chain disruptions or changes in major consuming countries’ policies significantly impacts price movements.

Factors Influencing Copper Prices

Several macroeconomic factors, supply and demand dynamics, geopolitical events, and the type of copper significantly influence copper prices.

Key macroeconomic factors include global economic growth, inflation rates, and interest rate adjustments. Strong economic growth typically boosts copper demand, while inflation and higher interest rates can dampen investment and reduce demand.

Supply and demand dynamics play a crucial role. Increased mining output or improved recycling rates can increase supply, potentially lowering prices. Conversely, rising demand from construction, electronics, and renewable energy sectors can drive prices higher.

- Supply Factors: Mine production levels, refining capacity, scrap metal availability, geopolitical instability in producing regions.

- Demand Factors: Global economic growth, infrastructure development, construction activity, electronics manufacturing, renewable energy adoption.

Geopolitical events, such as trade wars, sanctions, or political instability in major copper-producing countries, can significantly disrupt supply chains and influence prices. The type of copper, whether refined or cathode, also impacts pricing due to differences in purity and processing costs.

Major Copper Producing Countries & Companies

Several countries and companies dominate the global copper market, significantly influencing supply and price.

| Country | Production (Million Tonnes) |

|---|---|

| Chile | 5.5 |

| Peru | 2.2 |

| China | 1.8 |

| Australia | 1.5 |

| Democratic Republic of Congo | 1.2 |

| Company | Market Capitalization (USD Billion) |

|---|---|

| Codelco | 50 |

| BHP Group | 150 |

| Freeport-McMoRan | 40 |

| Rio Tinto | 120 |

| Glencore | 80 |

These countries and companies face various production challenges, including environmental regulations, labor disputes, and infrastructure limitations. Their actions and decisions heavily influence global copper supply and price stability.

Copper’s Use in Various Industries

Source: mining.com

Copper finds extensive use across diverse industries, making it a crucial metal in the modern economy. Its applications vary widely, reflecting its unique properties of conductivity and ductility.

Construction, electronics, and transportation are major consumers of copper. In construction, it’s used in wiring, plumbing, and roofing. The electronics industry relies heavily on copper for circuitry and wiring. Transportation uses it in vehicles’ electrical systems and infrastructure.

A bar chart illustrating copper consumption by sector would show construction as the largest consumer, followed by electronics and transportation. Other sectors, such as energy and industrial machinery, also contribute significantly to copper demand. Changes in these industries, such as increased infrastructure spending or growth in the electric vehicle market, directly influence copper consumption and pricing.

Copper stock prices today are influenced by a variety of global factors, including industrial demand and geopolitical events. It’s interesting to compare this volatility to the performance of other sectors; for instance, you might want to check the current bausch and lomb stock price to see how differently healthcare stocks are faring. Ultimately, understanding the copper market requires considering broader economic trends and comparing its performance against other investment options.

Textual representation of a bar chart:

Construction (50%), Electronics (25%), Transportation (15%), Energy (5%), Other (5%).

Future growth in copper demand is projected to be driven primarily by the expansion of renewable energy infrastructure, electric vehicles, and the continued growth of developing economies. However, technological advancements leading to copper substitution in certain applications might pose challenges.

Copper Price Predictions & Future Outlook, Copper stock price today

Predicting future copper prices is inherently challenging due to the market’s sensitivity to numerous factors. Expert opinions and forecasts vary, reflecting the inherent uncertainties. However, analyzing historical trends and current market conditions can provide a reasonable outlook.

Potential risks include economic slowdowns, supply chain disruptions, and technological advancements leading to the substitution of copper in certain applications. Factors that could lead to price increases include increased demand from renewable energy projects, infrastructure development in emerging economies, and geopolitical instability affecting supply.

A potential price trajectory for the next year could see prices fluctuating within a range, possibly influenced by global economic growth and supply chain dynamics. For example, a scenario of moderate economic growth and stable supply could lead to a modest price increase, while a global recession could result in lower prices. These predictions, however, should be considered as speculative and subject to change.

Questions Often Asked

What are the main uses of copper?

Copper’s primary uses span various sectors, including construction (wiring, plumbing), electronics (circuit boards), transportation (wiring, engines), and renewable energy (solar panels, wind turbines).

How does inflation affect copper prices?

High inflation often increases the cost of production and transportation, potentially driving up copper prices. Conversely, lower inflation can ease cost pressures, potentially leading to price decreases.

What are the risks associated with investing in copper stocks?

Risks include price volatility due to fluctuating demand and supply, geopolitical instability impacting production, and macroeconomic factors like recessionary periods.

Where can I find real-time copper price data?

Real-time copper price data is available from various financial news websites and commodity trading platforms.