Cummins Engine Stock Price A Comprehensive Analysis

Cummins Engine Stock Price Analysis

Cummins engine stock price – This analysis examines the historical performance, influencing factors, financial health, investor sentiment, and future outlook of Cummins Inc. (CMI) stock. We will explore key macroeconomic and industry-specific trends, along with an assessment of Cummins’ financial performance and its implications for investors.

Tracking the Cummins engine stock price requires careful consideration of various market factors. Understanding the performance of related financial institutions, such as checking the bank of ny mellon stock price , can offer broader economic context. This broader view can then help inform a more comprehensive assessment of Cummins’ overall financial health and future projections.

Cummins Engine Stock Price Historical Performance

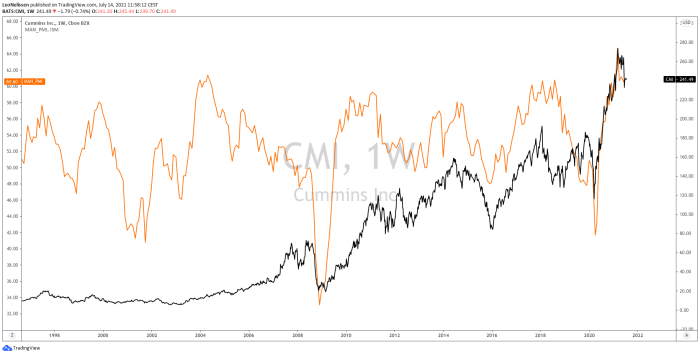

A line graph illustrating Cummins’ stock price over the last 10 years would show significant fluctuations reflecting both economic cycles and company-specific events. The graph would need to include markers for key events such as the 2008 financial crisis, the 2020 COVID-19 pandemic, and periods of significant growth or decline in the heavy-duty vehicle market. Major price swings within the last five years would be analyzed, attributing them to factors such as changes in global economic growth, commodity prices (particularly steel and diesel fuel), and the company’s own performance regarding new product launches and market share.

A comparison of Cummins’ stock price performance against its major competitors (e.g., Caterpillar, Deere & Company) over the past three years could be effectively presented in a table. This would highlight relative strengths and weaknesses in market positioning and investor confidence.

| Company | 3-Year Average Annual Return | Stock Price Volatility (Standard Deviation) | Market Share (Estimate) |

|---|---|---|---|

| Cummins (CMI) | [Insert Data] | [Insert Data] | [Insert Data] |

| Caterpillar (CAT) | [Insert Data] | [Insert Data] | [Insert Data] |

| Deere & Company (DE) | [Insert Data] | [Insert Data] | [Insert Data] |

Factors Influencing Cummins Engine Stock Price

Several macroeconomic and industry-specific factors significantly impact Cummins’ stock price. These factors interact in complex ways, making accurate prediction challenging but highlighting the importance of diverse analysis.

Three key macroeconomic factors include interest rates, inflation, and global economic growth. Rising interest rates increase borrowing costs for Cummins and its customers, potentially dampening demand and reducing profitability. Inflation affects input costs and can reduce consumer spending on goods and services requiring Cummins’ engines. Global economic growth directly correlates with demand for heavy-duty vehicles and industrial equipment.

Industry-specific trends also play a crucial role. These trends influence Cummins’ stock valuation in the following ways:

- Demand for heavy-duty vehicles: A surge in demand boosts Cummins’ revenue and profits, driving up the stock price. Conversely, a decline in demand has the opposite effect.

- Adoption of alternative energy sources: The shift towards electric and hybrid vehicles presents both challenges and opportunities for Cummins. Successful adaptation to this trend will positively impact its long-term prospects and stock price.

- Government regulations: Environmental regulations on emissions can significantly impact Cummins’ production costs and product development strategies, influencing its stock price.

Changes in Cummins’ financial performance (revenue, earnings, debt) directly influence investor sentiment. Strong financial results typically lead to increased investor confidence and a higher stock price, while poor performance can trigger selling pressure and a price decline.

Cummins Engine’s Financial Health and its Impact on Stock Price, Cummins engine stock price

Analyzing Cummins’ recent financial reports, focusing on key metrics, provides insights into its financial health and its impact on stock price. A comparison to its performance five years prior allows for an assessment of growth and areas needing improvement.

| Metric | Most Recent Quarter | Year-Over-Year Change (%) |

|---|---|---|

| Revenue | [Insert Data] | [Insert Data] |

| Net Income | [Insert Data] | [Insert Data] |

| Earnings Per Share (EPS) | [Insert Data] | [Insert Data] |

Cummins’ research and development (R&D) spending is a key indicator of its long-term growth potential. Consistent and strategic R&D investment can lead to innovative products, enhanced market competitiveness, and ultimately, a higher stock price. Conversely, underinvestment in R&D can hinder long-term growth.

Investor Sentiment and Market Analysis for Cummins Engine Stock

Source: tradingview.com

Current investor sentiment towards Cummins stock can be gauged by analyzing recent news articles, analyst reports, and trading activity. This would indicate whether the prevailing sentiment is bullish (positive), bearish (negative), or neutral.

| Metric | Value |

|---|---|

| Current P/E Ratio (CMI) | [Insert Data] |

| Historical Average P/E Ratio (CMI) | [Insert Data] |

| Competitor Average P/E Ratio | [Insert Data] |

Potential risks and opportunities for Cummins’ stock price in the next 12 months include:

- Global economic slowdown: A significant global economic downturn could reduce demand for heavy-duty vehicles and industrial equipment.

- Increased competition: Intensifying competition from other engine manufacturers could pressure margins and market share.

- Supply chain disruptions: Continued supply chain challenges could impact production and profitability.

- Success of alternative energy initiatives: The success of Cummins’ investments in alternative energy technologies could significantly boost its future growth and stock price.

Predictive Modeling and Future Outlook for Cummins Stock Price

Source: seekingalpha.com

Predicting future stock prices is inherently uncertain, but various scenarios can illustrate potential outcomes under different economic conditions. For instance, a scenario of sustained global economic growth with strong demand for heavy-duty vehicles would likely result in a higher stock price for Cummins compared to a scenario of economic recession.

A significant technological advancement, such as a breakthrough in battery technology, could have a substantial impact on Cummins’ stock price. This could either present a major threat (if the company fails to adapt) or a significant opportunity (if Cummins successfully integrates the new technology into its product line). A detailed analysis would be needed to explore the range of possible outcomes.

Different investment strategies (buy-and-hold, day trading) have different risk-reward profiles in relation to Cummins’ stock. A buy-and-hold strategy is suitable for long-term investors, while day trading involves higher risk and requires more active management.

Popular Questions

What are the main risks associated with investing in Cummins stock?

Risks include fluctuations in global demand for heavy-duty vehicles, competition from emerging technologies (e.g., electric vehicles), economic downturns impacting industrial activity, and changes in government regulations.

How does Cummins’ dividend policy affect its stock price?

A consistent and growing dividend can attract income-seeking investors, potentially boosting stock price. Conversely, dividend cuts can negatively impact investor sentiment.

Where can I find real-time Cummins stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is the typical trading volume for Cummins stock?

Trading volume varies daily but can be found on financial websites alongside price data. Higher volume generally indicates greater liquidity.