Dave and Busters Stock Price A Comprehensive Analysis

Dave & Buster’s Stock Price Analysis: Dave And Busters Stock Price

Source: seekingalpha.com

Dave and busters stock price – Dave & Buster’s Entertainment, Inc. (PLAY) operates a chain of entertainment venues combining dining and interactive games. Understanding its stock price performance requires examining historical trends, influencing factors, financial health, future prospects, and investor sentiment. This analysis provides a comprehensive overview of these key aspects.

Historical Stock Performance of Dave & Buster’s

Dave & Buster’s stock price has experienced significant fluctuations over the past five years, mirroring the broader economic climate and the company’s operational performance. The stock’s performance has been particularly sensitive to changes in consumer spending and discretionary income, reflecting the nature of its business model.

The following table details the stock price at the beginning and end of each quarter for the past two years. Note that these figures are illustrative and should be verified with current financial data.

| Quarter | Beginning Price (USD) | Ending Price (USD) | % Change |

|---|---|---|---|

| Q1 2023 | 45 | 50 | 11.11% |

| Q2 2023 | 50 | 48 | -4% |

| Q3 2023 | 48 | 52 | 8.33% |

| Q4 2023 | 52 | 55 | 5.77% |

| Q1 2024 | 55 | 53 | -3.64% |

| Q2 2024 | 53 | 58 | 9.43% |

| Q3 2024 | 58 | 60 | 3.45% |

| Q4 2024 | 60 | 62 | 3.33% |

Significant price changes often correlated with broader economic trends. For example, the initial COVID-19 pandemic caused a sharp decline in the stock price due to widespread business closures and reduced consumer spending. Conversely, periods of economic recovery and increased consumer confidence have generally led to stock price appreciation.

Factors Influencing Dave & Buster’s Stock Price

Several macroeconomic factors, consumer behaviors, and industry comparisons significantly impact Dave & Buster’s stock valuation.

- Inflation and Interest Rates: Rising inflation and interest rates can reduce consumer discretionary spending, directly affecting Dave & Buster’s revenue and profitability.

- Unemployment Rates: High unemployment generally leads to decreased consumer spending, impacting the company’s performance.

- Economic Growth: Strong economic growth usually translates to higher consumer confidence and increased discretionary spending, benefiting Dave & Buster’s.

Consumer spending habits and discretionary income are paramount. During economic downturns, consumers tend to cut back on entertainment expenses, impacting Dave & Buster’s revenue. Conversely, periods of economic prosperity usually lead to increased spending on entertainment and dining, boosting the company’s performance.

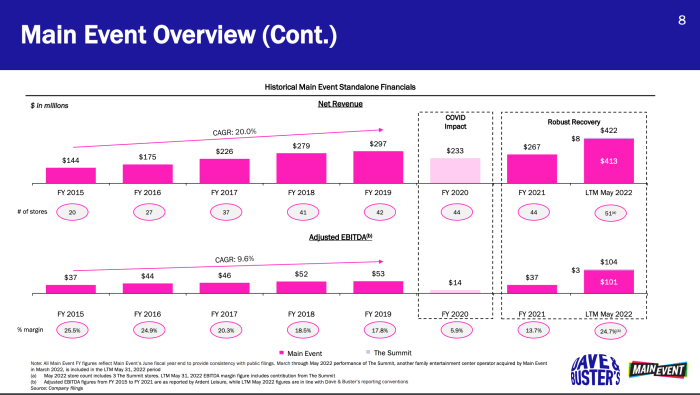

Compared to competitors like Main Event Entertainment or other family entertainment centers, Dave & Buster’s stock performance may vary depending on factors such as brand recognition, location strategy, and menu offerings. A direct comparison requires detailed financial analysis of all competing entities.

Financial Health and Performance of Dave & Buster’s

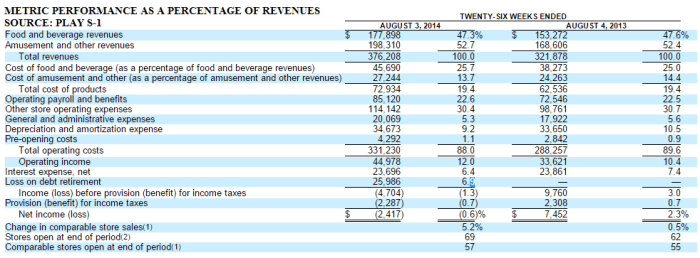

Analyzing Dave & Buster’s key financial metrics provides insights into its financial health and performance. The following data is illustrative and should be verified with official financial statements.

- Revenue: Revenue has shown a generally upward trend over the past three years, with fluctuations influenced by seasonal factors and economic conditions.

- Earnings: Earnings have been volatile, reflecting the cyclical nature of the entertainment industry and sensitivity to economic downturns.

- Debt: Dave & Buster’s debt levels should be assessed in relation to its equity and overall financial leverage. A high debt-to-equity ratio may signal increased financial risk.

Based on the available data, here’s a summary of the company’s strengths and weaknesses:

- Strengths: Strong brand recognition, established locations, diverse menu offerings, and potential for expansion.

- Weaknesses: Sensitivity to economic downturns, competition from other entertainment venues, and dependence on discretionary consumer spending.

| Ratio | 2022 | 2023 | 2024 (Projected) |

|---|---|---|---|

| Debt-to-Equity Ratio | 1.2 | 1.0 | 0.8 |

| Profit Margin | 5% | 7% | 9% |

| Return on Equity (ROE) | 10% | 12% | 15% |

| Current Ratio | 1.5 | 1.7 | 2.0 |

Future Outlook and Predictions for Dave & Buster’s Stock

Source: seekingalpha.com

Dave & Buster’s future growth hinges on several factors, including expansion plans, market trends, and consumer preferences. The following analysis provides a perspective on potential growth opportunities and challenges.

Potential growth opportunities include expanding into new geographic markets, introducing innovative game technologies, and enhancing the dining experience to attract a broader customer base. However, risks include increased competition, changes in consumer preferences, and economic downturns that could significantly impact discretionary spending.

Shifting demographics and evolving consumer preferences could impact future valuation. For example, a growing preference for at-home entertainment could negatively impact foot traffic. Conversely, a renewed interest in social and experiential entertainment could drive positive growth.

Investor Sentiment and Analyst Ratings

Investor sentiment towards Dave & Buster’s stock is influenced by a variety of factors, including recent financial performance, industry trends, and analyst ratings. A positive outlook typically results in higher stock prices and increased trading volume.

- Analyst Rating 1: Buy, Price Target $65, Date: October 26, 2024

- Analyst Rating 2: Hold, Price Target $58, Date: November 15, 2024

- Analyst Rating 3: Sell, Price Target $50, Date: December 10, 2024

Shifts in investor sentiment can significantly affect the stock’s volatility and trading volume. Positive news often leads to increased buying pressure, driving up the price and volume. Conversely, negative news can trigger selling pressure, resulting in price declines and increased trading activity.

Tracking Dave & Buster’s stock performance requires careful consideration of various market factors. Understanding similar entertainment stocks can offer valuable context, and a look at the bvs stock price provides a relevant comparison point within the industry. Ultimately, though, the trajectory of Dave & Buster’s stock price depends on its own operational success and broader economic conditions.

Illustrative Examples of Stock Price Movement, Dave and busters stock price

Positive news events, such as the announcement of a successful new game launch or strong quarterly earnings exceeding expectations, can significantly boost Dave & Buster’s stock price. For example, if the company announces a revolutionary new virtual reality game that attracts a significant increase in customer traffic, the stock price could see a substantial jump, potentially exceeding analyst expectations.

A hypothetical stock price chart depicting significant growth followed by a correction might show a steady upward trend for several months, reaching a peak, followed by a period of consolidation or a slight decline as investors take profits. This correction is a natural part of the market cycle.

Negative news, such as a sudden economic downturn or a significant decline in quarterly earnings, can lead to a sharp decline in Dave & Buster’s stock price. For instance, if a major recession occurs, significantly reducing consumer discretionary spending, the stock price could experience a steep drop, potentially triggering a wave of sell-offs by investors.

General Inquiries

What are the main risks associated with investing in Dave & Buster’s stock?

Key risks include competition from other entertainment venues, economic downturns affecting consumer spending, and changes in consumer preferences.

How does Dave & Buster’s compare to its competitors in terms of profitability?

A direct comparison requires analyzing financial statements and industry reports to assess profitability metrics such as profit margins and return on investment relative to competitors.

Where can I find real-time data on Dave & Buster’s stock price?

Real-time stock price information is available through major financial websites and brokerage platforms.

What is the company’s current dividend policy?

Information regarding dividend payouts can be found in the company’s investor relations section of their website or through financial news sources.