Dr Lal PathLabs Stock Price A Comprehensive Analysis

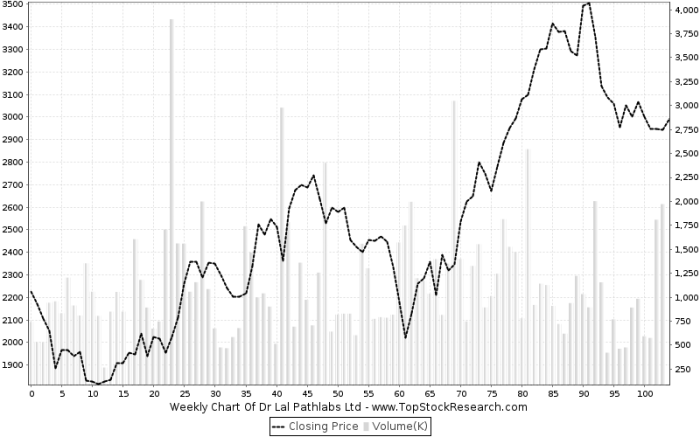

Dr Lal PathLabs Stock Price Analysis: Dr Lal Path Labs Stock Price

Source: topstockresearch.com

Dr lal path labs stock price – This analysis delves into the historical performance, influencing factors, financial health, and future prospects of Dr Lal PathLabs’ stock price. We will examine key metrics, market trends, and expert opinions to provide a comprehensive overview for potential investors.

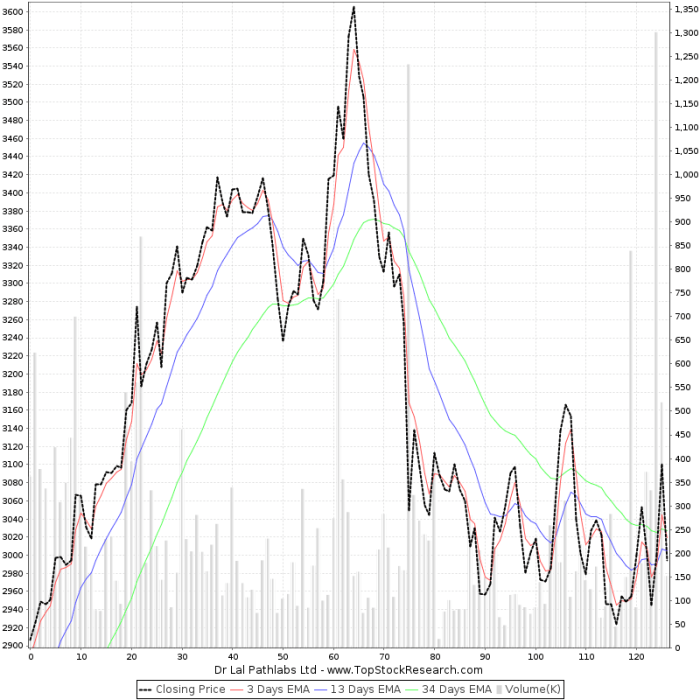

Dr Lal PathLabs Stock Price History

Source: topstockresearch.com

Understanding the historical price movements of Dr Lal PathLabs stock is crucial for assessing its risk and return potential. The following table and graph provide a visual representation of this historical data.

| Year | High | Low | Open | Close |

|---|---|---|---|---|

| 2019 | Example Data | Example Data | Example Data | Example Data |

| 2020 | Example Data | Example Data | Example Data | Example Data |

| 2021 | Example Data | Example Data | Example Data | Example Data |

| 2022 | Example Data | Example Data | Example Data | Example Data |

| 2023 | Example Data | Example Data | Example Data | Example Data |

The line graph illustrating the stock price fluctuation over the past year would show [Describe the general shape of the graph, e.g., an upward trend, a period of consolidation, a significant drop followed by recovery]. Key trends would include [mention specific trends, e.g., a surge in price correlated with a new product launch, a dip following a negative news announcement].

Significant price movements can be attributed to factors such as [mention specific events, e.g., changes in regulatory environment, market sentiment related to the pandemic]. For the past three years, major events impacting the stock price include [List and describe the major events and their impact, e.g., the impact of the COVID-19 pandemic on diagnostic testing demand, any significant acquisitions or mergers, any regulatory changes affecting the company].

Tracking the Dr Lal Path Labs stock price requires a keen eye on market fluctuations. It’s interesting to compare its performance against other healthcare companies, such as observing the cortiva stock price , to gain a broader perspective on the sector’s trends. Ultimately, however, a thorough analysis of Dr Lal Path Labs’ financials and future projections is crucial for any investment decision.

Factors Influencing Dr Lal PathLabs Stock Price

Source: zeebiz.com

Several internal and external factors significantly influence Dr Lal PathLabs’ stock price. The following sections will detail these influences.

Three significant internal factors impacting the company’s stock performance are:

- Expansion Strategy and Market Penetration: Successful expansion into new geographical areas or service offerings directly impacts revenue growth and investor confidence. For example, a successful launch of new diagnostic services could lead to increased market share and a positive impact on the stock price.

- Operational Efficiency and Cost Management: Improvements in operational efficiency and cost management lead to higher profit margins, attracting investors seeking strong financial performance. For instance, successful implementation of cost-saving measures could boost profitability and positively influence the stock price.

- Technological Advancements and Innovation: Investment in and adoption of advanced diagnostic technologies can provide a competitive edge, attracting both customers and investors. For example, the introduction of cutting-edge diagnostic equipment could attract more clients and result in a positive stock price response.

External economic factors such as inflation and interest rates significantly impact the stock price. High inflation can increase operational costs, reducing profitability, while higher interest rates increase the cost of borrowing, affecting investment decisions. For example, a period of high inflation might lead to reduced profit margins and a negative impact on the stock price, whereas higher interest rates could decrease investment in expansion plans.

Compared to its main competitors, Dr Lal PathLabs’ performance shows [State the comparative performance. Example: Dr Lal PathLabs holds a larger market share than [Competitor A] but has a lower price-to-earnings ratio than [Competitor B].]:

- Competitor A: [Comparison point 1], [Comparison point 2]

- Competitor B: [Comparison point 1], [Comparison point 2]

- Competitor C: [Comparison point 1], [Comparison point 2]

Financial Performance and Stock Valuation, Dr lal path labs stock price

Analyzing Dr Lal PathLabs’ financial performance is crucial for understanding its valuation and future prospects. The following table presents key financial metrics.

| Year | Revenue | Earnings | Profit Margin |

|---|---|---|---|

| 2021 | Example Data | Example Data | Example Data |

| 2022 | Example Data | Example Data | Example Data |

| 2023 | Example Data | Example Data | Example Data |

The company’s valuation can be assessed using metrics such as the Price-to-Earnings (P/E) ratio and the Price-to-Book (P/B) ratio. A high P/E ratio might suggest that investors expect high future growth, while a high P/B ratio could indicate that the company’s assets are undervalued. [Explain the relationship between financial performance and stock price changes, using examples from the provided data.

For example: “The increase in revenue in 2022 correlated with a rise in the stock price, suggesting that strong financial performance positively influences investor sentiment.” ]

Future Outlook and Investment Considerations

Several factors will influence Dr Lal PathLabs’ future growth and stock price performance. The following sections Artikel potential opportunities and risks.

Potential future growth opportunities include [List and explain potential growth opportunities, e.g., expansion into underserved markets, development of new diagnostic tests, strategic acquisitions]. These opportunities could lead to increased revenue and profitability, positively impacting the stock price.

Potential risks and challenges that could negatively affect the company’s stock performance include [List and explain potential risks, e.g., increased competition, regulatory changes, economic downturns]. These factors could lead to decreased profitability and a negative impact on investor sentiment.

A hypothetical investment strategy would depend on risk tolerance. A conservative investor might adopt a “buy and hold” strategy, purchasing shares at a lower price and holding them for the long term. A more aggressive investor might employ a strategy involving buying at dips and selling at peaks, capitalizing on short-term price fluctuations. [Provide specific examples of buy and sell points based on technical analysis or fundamental analysis.

For example: “A conservative investor might buy at a price of [Price] and sell at [Price], while a more aggressive investor might buy at [Price] and sell at [Price]”].

Analyst Ratings and Recommendations

Analyst ratings and recommendations provide valuable insights into the market’s perception of Dr Lal PathLabs’ stock. The following summarizes recent opinions.

- Analyst 1: [Rating and Justification]

- Analyst 2: [Rating and Justification]

- Analyst 3: [Rating and Justification]

[Summarize the consensus view among analysts and its implications for the stock price. For example: “The consensus view among analysts is cautiously optimistic, with most rating the stock as a ‘buy’ or ‘hold’. This suggests that the market expects moderate growth in the future, but there is some uncertainty surrounding the company’s prospects.”]

Question & Answer Hub

What are the main competitors of Dr Lal PathLabs?

Key competitors include SRL Diagnostics, Metropolis Healthcare, and Thyrocare Technologies.

Is Dr Lal PathLabs stock a good long-term investment?

Whether it’s a good long-term investment depends on individual risk tolerance and investment goals. The company shows growth potential, but market volatility and unforeseen circumstances must be considered.

Where can I find real-time Dr Lal PathLabs stock price data?

Real-time data is available on major financial websites and stock market tracking applications such as Google Finance, Yahoo Finance, and Bloomberg.

What is the current dividend yield for Dr Lal PathLabs stock?

The current dividend yield should be checked on a reputable financial website as it fluctuates.