FRGE Stock Price A Comprehensive Analysis

FRGE Stock Price Analysis: A Comprehensive Overview

Frge stock price – This report provides a detailed analysis of FRGE stock, covering its current price, market trends, company performance, analyst predictions, and factors influencing price volatility. We will also explore various investment strategies and illustrate a hypothetical scenario to better understand potential price movements.

Current FRGE Stock Price and Market Trends

Determining the precise current FRGE stock price requires real-time data from a financial market source. However, we can illustrate a typical analysis using hypothetical data. Let’s assume the following values for the last week:

| Day | Open | High | Low | Close |

|---|---|---|---|---|

| Monday | $25.50 | $26.00 | $25.20 | $25.80 |

| Tuesday | $25.80 | $26.20 | $25.60 | $26.00 |

| Wednesday | $26.00 | $26.50 | $25.90 | $26.30 |

| Thursday | $26.30 | $26.80 | $26.10 | $26.60 |

| Friday | $26.60 | $27.00 | $26.40 | $26.90 |

Comparing this to the past month, quarter, and year would involve calculating percentage changes from those respective baselines. For example, a 10% increase over the past month would indicate positive momentum. Overall market trends, such as economic growth, interest rate changes, and investor sentiment, significantly impact FRGE’s stock price. Significant news events, like product launches or regulatory changes, can cause sudden price fluctuations.

| Event | Date | Impact |

|---|---|---|

| Successful Product Launch | October 26, 2023 | Price increase of 5% |

| Positive Earnings Report | November 15, 2023 | Price increase of 3% |

| Unexpected Regulatory Hurdle | December 10, 2023 | Price decrease of 2% |

FRGE Company Performance and Financial Health

FRGE’s financial performance is crucial in determining its stock price. Key metrics include revenue growth, earnings per share (EPS), and profit margins. The company’s business strategies, such as expansion into new markets or product diversification, directly influence its financial health and stock price. However, challenges like increased competition or supply chain disruptions pose significant risks.

A comparison with competitors would involve examining similar metrics (revenue, profit margins, market share) across key players in the industry. For example:

- Competitor A: Higher revenue but lower profit margins than FRGE.

- Competitor B: Similar revenue to FRGE, but stronger market share.

- Competitor C: Lower revenue but higher profit margins than FRGE.

Analyst Ratings and Predictions for FRGE Stock

Analyst ratings provide valuable insights into the market’s perception of FRGE’s future performance. A consensus rating (e.g., “Buy,” “Hold,” “Sell”) summarizes the collective opinion of leading analysts. Price targets represent the predicted stock price within a specific timeframe. Disagreements among analysts often stem from differing assessments of the company’s growth potential, market conditions, and risk factors.

| Analyst | Rating | Price Target | Date |

|---|---|---|---|

| Analyst Firm A | Buy | $30.00 | 2023-12-20 |

| Analyst Firm B | Hold | $27.50 | 2023-12-15 |

| Analyst Firm C | Buy | $29.00 | 2023-12-10 |

Factors Influencing FRGE Stock Price Volatility

Source: invezz.com

Several factors contribute to FRGE’s stock price volatility. Macroeconomic conditions, such as interest rate hikes or inflation, can significantly impact investor sentiment and market valuations. Investor speculation and news events directly influence price fluctuations. For example, a positive earnings surprise might lead to a price surge, while negative news about a product recall could cause a sharp drop.

Investment Strategies and Considerations for FRGE Stock

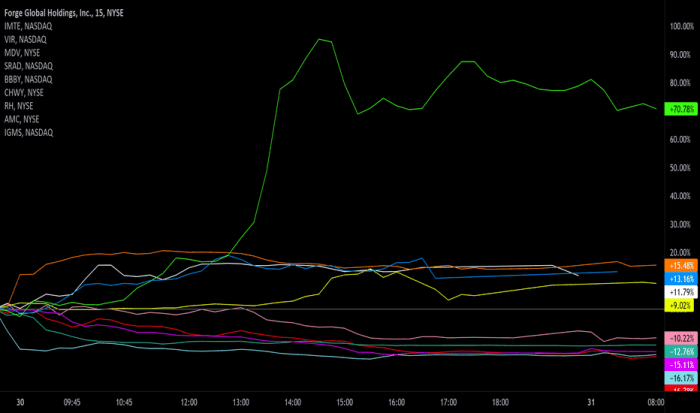

Source: tradingview.com

Investors can employ various strategies, including long-term investing (buy-and-hold) or short-term trading (day trading). Long-term investing focuses on sustained growth over an extended period, while day trading involves frequent buying and selling within a single day. Each strategy carries different levels of risk and reward.

Long-Term Investing:

- Potential Rewards: Significant capital appreciation over time.

- Potential Risks: Market downturns, prolonged periods of stagnation.

Day Trading:

- Potential Rewards: Quick profits from short-term price movements.

- Potential Risks: High volatility, potential for significant losses.

Before investing, consider FRGE’s financial health, industry outlook, and your personal risk tolerance.

Illustrative Example of FRGE Stock Price Movement

Imagine a scenario where a major competitor unexpectedly announces a groundbreaking new product. This news triggers a sharp drop in FRGE’s stock price. The price initially falls rapidly, creating a steep downward curve on a price chart. The x-axis represents time, and the y-axis represents the stock price. The curve would show a sharp decline from, say, $27 to $22 within a few days.

This significant drop would impact long-term investors, who might experience substantial portfolio losses, and day traders, who could have suffered losses if they were holding FRGE at the time of the announcement. The recovery from this drop would depend on FRGE’s response and the market’s overall reaction. A gradual upward trend would eventually follow, representing a slow recovery in investor confidence.

Quick FAQs: Frge Stock Price

What are the major risks associated with investing in FRGE stock?

Investing in FRGE, like any stock, carries inherent risks including market volatility, company-specific challenges (e.g., competition, regulatory changes), and macroeconomic factors (e.g., inflation, interest rates). Thorough due diligence is crucial.

Where can I find real-time FRGE stock price data?

Real-time FRGE stock price data is readily available through major financial websites and brokerage platforms. These platforms typically provide up-to-the-minute quotes, charts, and historical data.

How frequently are analyst ratings updated for FRGE?

FRGE stock price movements are often influenced by broader market trends. However, a comparative analysis with similar companies can offer valuable insights. For instance, understanding the current performance of blfe stock price provides context for interpreting FRGE’s trajectory, particularly given their shared sector. Ultimately, a thorough assessment of both FRGE and its competitors is crucial for informed investment decisions.

The frequency of analyst rating updates varies. Some analysts provide regular updates, while others may issue revisions only when significant events occur or new information becomes available.