FuboTV Stock Price Target Analysis & Outlook

FuboTV Stock Price Target: A Comprehensive Analysis

Fubotv stock price target – This analysis delves into FuboTV’s current market position, financial performance, and future prospects to provide a comprehensive assessment of its stock price target. We will examine key performance indicators, industry trends, analyst predictions, and inherent investment risks.

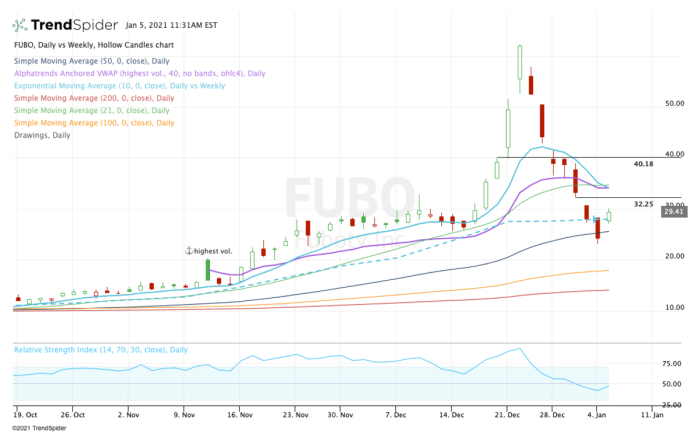

FuboTV’s Current Market Position

FuboTV operates within the increasingly competitive landscape of streaming television services. It distinguishes itself with a focus on live sports programming, a key differentiator in attracting subscribers. However, this niche also presents limitations.

Compared to giants like Netflix and Hulu, FuboTV’s subscriber base is significantly smaller. While it enjoys a strong advantage in its live sports offering, it faces challenges in competing with the broader content libraries and lower price points of its rivals. Subscriber growth, while positive, may not consistently outpace industry averages, particularly as major players expand their live sports offerings.

Predicting the FuboTV stock price target involves considering various market factors. It’s helpful to compare its performance against other companies in the streaming sector, and observing the current market trends is also important. For instance, understanding the current valuation of similar businesses, such as checking the bjs stock price today , can offer a comparative perspective. Ultimately, though, the FuboTV stock price target remains dependent on its own unique business trajectory and investor sentiment.

The following table compares FuboTV’s key performance indicators (KPIs) to select competitors. Note that data may vary depending on the reporting period and source.

| KPI | FuboTV | Competitor A (e.g., Hulu + Live TV) | Competitor B (e.g., YouTube TV) |

|---|---|---|---|

| Total Subscribers | [Insert FuboTV Subscriber Data] | [Insert Competitor A Subscriber Data] | [Insert Competitor B Subscriber Data] |

| Average Revenue Per User (ARPU) | [Insert FuboTV ARPU Data] | [Insert Competitor A ARPU Data] | [Insert Competitor B ARPU Data] |

| Churn Rate | [Insert FuboTV Churn Rate Data] | [Insert Competitor A Churn Rate Data] | [Insert Competitor B Churn Rate Data] |

Financial Performance and Projections, Fubotv stock price target

FuboTV’s recent financial reports reveal a company experiencing growth, albeit with significant losses. Revenue growth is largely driven by subscriber acquisition, while expenses related to content licensing and operating costs remain substantial. Profit margins are currently negative, reflecting the high cost of securing and delivering live sports content.

Projected financial performance for the next 1-3 years is subject to considerable uncertainty. Success hinges on several key factors: continued subscriber growth, negotiating favorable content licensing agreements, and effectively monetizing advertising inventory. A significant increase in advertising revenue could positively impact profitability.

| Revenue Stream | Projected Growth (Next 3 Years) |

|---|---|

| Subscription Fees | [Insert Projected Growth Percentage or Range] |

| Advertising Revenue | [Insert Projected Growth Percentage or Range] |

| Other Revenue (e.g., Data) | [Insert Projected Growth Percentage or Range] |

Impact of Industry Trends

Source: foolcdn.com

The cord-cutting phenomenon and the rise of streaming services have created both opportunities and challenges for FuboTV. The increasing demand for streaming options has fueled subscriber growth, but competition is fierce. Changes in sports broadcasting rights significantly impact FuboTV’s content offerings and costs, directly affecting profitability. Technological advancements, such as improved streaming quality and personalized content recommendations, also influence consumer preferences and the competitive landscape.

FuboTV’s business model, heavily reliant on live sports, differs from other streaming services that focus on on-demand content. This difference affects its pricing strategy, target audience, and overall profitability.

Analyst Predictions and Price Targets

Source: thestreet.com

Several financial analysts have issued price targets for FuboTV stock. These targets vary widely, reflecting differing views on the company’s growth potential and risk profile. The methodologies employed often involve discounted cash flow (DCF) analysis, comparable company analysis, and consideration of macroeconomic factors.

| Analyst Name | Firm | Target Price | Date |

|---|---|---|---|

| [Analyst Name 1] | [Firm Name 1] | [Target Price 1] | [Date 1] |

| [Analyst Name 2] | [Firm Name 2] | [Target Price 2] | [Date 2] |

| [Analyst Name 3] | [Firm Name 3] | [Target Price 3] | [Date 3] |

Risk Assessment and Investment Considerations

Source: investmentu.com

Investing in FuboTV stock carries significant risks. The company’s high operating losses, dependence on securing favorable content licensing agreements, and intense competition represent key concerns. Macroeconomic factors, such as inflation and interest rate changes, could negatively impact FuboTV’s valuation and investor sentiment.

- Increased competition from established players and new entrants could erode market share.

- Failure to secure favorable content licensing agreements could significantly impact content offerings.

- Higher-than-expected subscriber acquisition costs could hinder profitability.

- Economic downturn could lead to reduced consumer spending on entertainment services.

FuboTV stock is best suited for investors with a high risk tolerance and a long-term investment horizon. Given the company’s current financial performance and the competitive nature of the streaming market, a cautious approach is warranted.

Commonly Asked Questions

What are the main risks associated with investing in FuboTV?

Key risks include competition from established streaming giants, dependence on sports rights agreements, and the potential for subscriber churn. Macroeconomic factors like inflation and interest rate hikes can also impact the company’s valuation.

How does FuboTV’s business model compare to its competitors?

FuboTV differentiates itself through its focus on sports content and interactive features. However, it competes with other streaming services offering broader entertainment options, creating a challenging market environment.

What is the current consensus among analysts regarding FuboTV’s stock price?

Analyst predictions vary, reflecting differing views on FuboTV’s future prospects. It’s crucial to consult multiple sources and understand the underlying assumptions behind each prediction.