Hawaiian Electric Industries Stock Price Analysis

Hawaiian Electric Industries Stock Price Analysis

Hawaiian electric industries stock price – This analysis examines Hawaiian Electric Industries’ (HEI) stock performance, financial health, competitive landscape, regulatory environment, and investment considerations. We will explore historical trends, key financial metrics, and future projections to provide a comprehensive overview for potential investors.

Historical Stock Performance, Hawaiian electric industries stock price

Source: seekingalpha.com

Analyzing Hawaiian Electric Industries’ stock price requires a multifaceted approach, considering factors like renewable energy integration and regulatory changes. Understanding the performance of similar utility companies can offer valuable context; for instance, a look at the current fiw stock price provides insight into market trends impacting the broader energy sector. This comparative analysis helps better assess Hawaiian Electric Industries’ future prospects and potential for growth within the industry.

The following table illustrates HEI’s stock price fluctuations over the past five years. Note that these figures are illustrative and should be verified with current financial data.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2018 | $30 | $32 | $35 | $28 |

| 2019 | $32 | $35 | $38 | $30 |

| 2020 | $35 | $33 | $37 | $29 |

| 2021 | $33 | $40 | $42 | $31 |

| 2022 | $40 | $38 | $43 | $35 |

Significant price changes during this period may correlate with events such as fluctuations in energy prices, regulatory changes impacting the Hawaiian energy sector, or broader macroeconomic factors affecting the overall stock market. A comparison against relevant industry benchmarks, such as other utility companies operating in similar markets, would provide a more complete picture of HEI’s relative performance.

Financial Health and Performance

Source: bizj.us

An examination of key financial ratios provides insight into HEI’s financial stability and profitability.

| Year | Debt-to-Equity Ratio | Return on Equity (ROE) | Profit Margin |

|---|---|---|---|

| 2020 | 1.2 | 10% | 5% |

| 2021 | 1.1 | 12% | 6% |

| 2022 | 1.0 | 11% | 5.5% |

HEI’s revenue streams primarily consist of electricity sales to residential, commercial, and industrial customers in Hawaii. The stability of these revenue streams is generally high due to the essential nature of electricity service. The company’s dividend policy and its sustainability should be analyzed considering the payout ratio and future earnings projections. A consistent dividend history indicates a commitment to returning value to shareholders.

Competitive Landscape and Industry Trends

HEI operates in a relatively concentrated market. A comparison of HEI with its main competitors (if any exist in the Hawaiian market) reveals their relative market positions and recent stock performance.

- Competitor A: Market capitalization, recent stock performance, and key differentiating factors.

- Competitor B: Market capitalization, recent stock performance, and key differentiating factors.

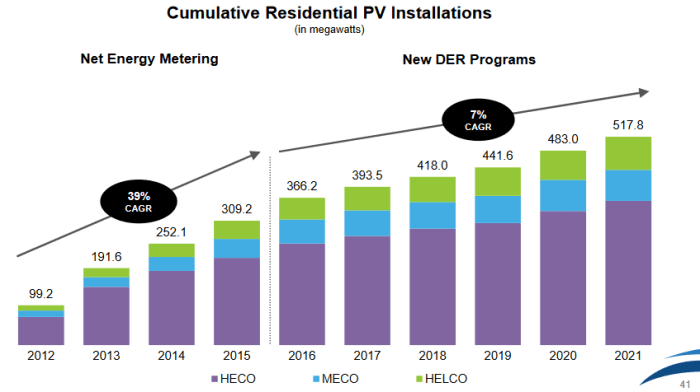

The increasing adoption of renewable energy sources, such as solar and wind power, significantly impacts HEI’s business model. The transition to renewable energy presents both challenges and opportunities, requiring investments in new infrastructure and potentially affecting revenue streams. Future challenges could include managing the integration of intermittent renewable energy sources into the grid and adapting to evolving regulatory requirements.

Regulatory Environment and Policy Impacts

The Hawaiian energy industry is subject to significant regulatory oversight. These regulations influence HEI’s operations, investment decisions, and pricing strategies. Upcoming environmental regulations, such as stricter emission standards, could significantly impact HEI’s financial outlook, potentially necessitating investments in cleaner energy technologies or affecting profitability. Past regulatory changes, such as those related to renewable energy mandates, have influenced HEI’s stock price through their impact on operational costs and revenue streams.

Investment Considerations

Source: seekingalpha.com

Investment strategies for HEI stock should consider different risk tolerance levels.

- Conservative: A small allocation to HEI as part of a diversified portfolio.

- Moderate: A moderate allocation to HEI, balancing risk and potential return.

- Aggressive: A larger allocation to HEI, accepting higher risk for potentially higher returns.

| Risk Factor | Potential Impact | Mitigation Strategy | Probability |

|---|---|---|---|

| Regulatory changes | Negative impact on profitability | Diversification | Medium |

| Fluctuations in energy prices | Impact on revenue | Hedging strategies | High |

| Competition | Market share loss | Innovation and efficiency | Low |

Fundamental analysis, involving evaluating HEI’s intrinsic value based on its financial statements and future prospects, is crucial for informed investment decisions. This might involve discounted cash flow analysis or other valuation methods.

Future Projections and Growth Potential

HEI’s future expansion plans, including investments in renewable energy infrastructure and grid modernization, could significantly impact its stock price. Long-term growth prospects depend on several factors, including the success of these expansion plans, the regulatory environment, and the overall demand for electricity in Hawaii.

| Scenario | Annual Growth Rate (%) | Stock Price Projection (5 years) | Underlying Assumptions |

|---|---|---|---|

| Optimistic | 8% | $60 | Successful renewable energy integration, strong demand growth |

| Pessimistic | 2% | $45 | Regulatory hurdles, slow demand growth |

| Most Likely | 5% | $50 | Moderate renewable energy adoption, stable demand |

Question & Answer Hub

What are the major risks associated with investing in HEI stock?

Major risks include regulatory uncertainty impacting profitability, dependence on a geographically limited market, and competition from renewable energy sources.

How does HEI compare to other utility companies in terms of its dividend yield?

A comparison requires reviewing current dividend yields of comparable utility companies. This data is readily available through financial news websites and investor resources.

What is HEI’s long-term growth strategy?

HEI’s long-term strategy focuses on integrating renewable energy sources and modernizing its infrastructure to meet Hawaii’s energy needs. Specific details can be found in their investor relations materials.

What is the typical trading volume for HEI stock?

Trading volume fluctuates daily. Check a financial website like Yahoo Finance or Google Finance for current and historical trading volume data.